What cause the recent market sell-off?

Potential US slowdown, Japan sudden interest rate hike, FED consider 50 bps rate cut, Iran and its Middle East tension. what we learn from covid-19

Many investors text/call me concerning the market.

If we reflect on history, we’ve seen these fluctuations occur repeatedly. Markets move in waves—sometimes up, sometimes down—it’s a natural part of the market cycle.

As your unit trust consultant, my role is to keep you informed and provide a reliable market roadmap to guide your investments in this volatile environment.”

KLCI Performance (As of Midday, August 5, 2024):

The KLCI (FTSE Malaysia KLCI) declined by 44.38 points to 1566.67, representing a 2.75% drop due to negative news globally.

Technically it’s not a crash yet. So steady. Don’t get too nervous.

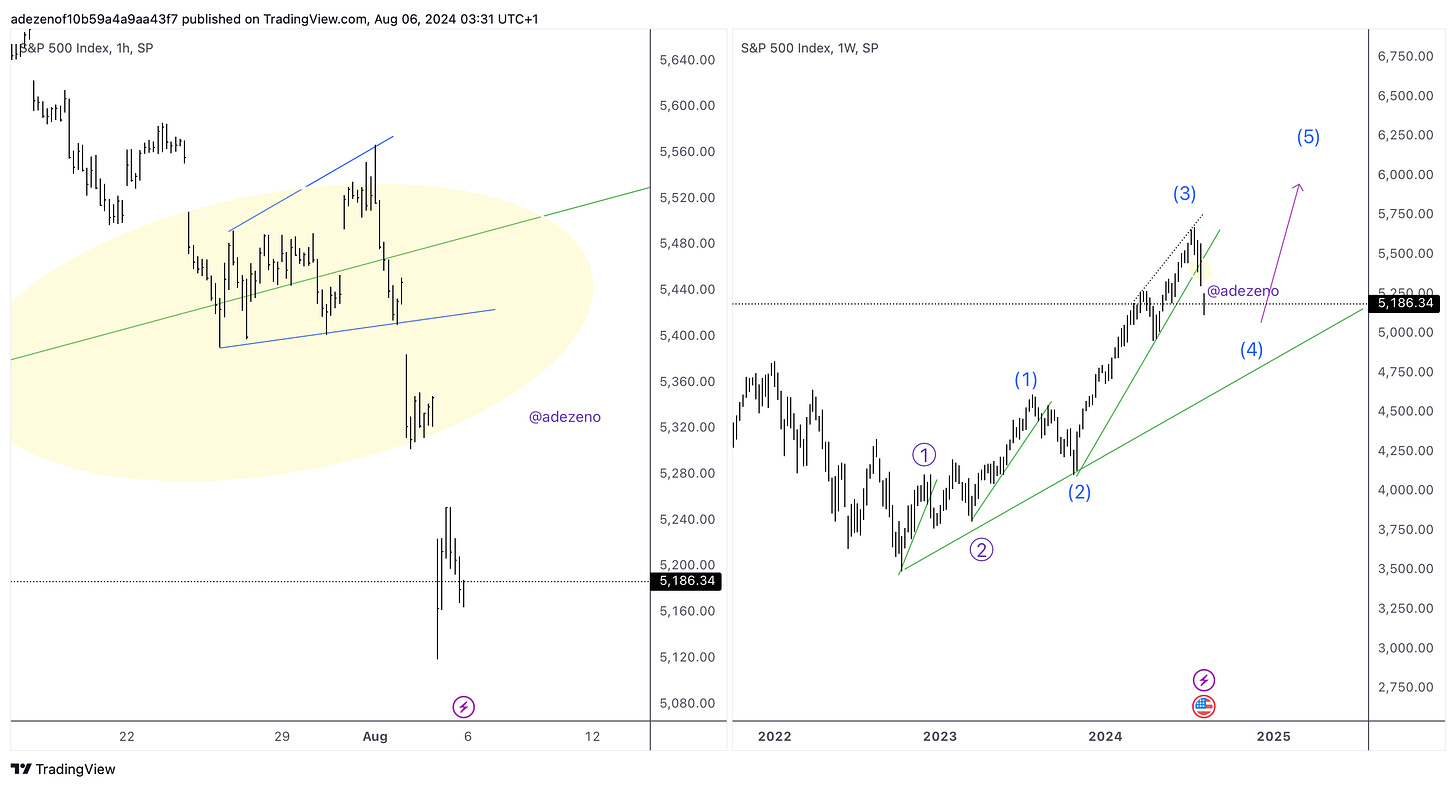

As mentioned in my previous newsletter “Global Market Report 3 - Aug 2024 edition” the global market is in the corrective structure. Either wave 2 (China) or wave 4 (US and other countries)

Therefore the sell-off that happened in the last few trading days is part of a natural cycle of the market.

So what causes a sudden sell-off?

US Economic Concerns:

Speculation arose due to concerns about a potential US economic slowdown (a “hard landing”) after Friday’s jobs report.

Market participants speculated that the US Federal Reserve might consider a 50 basis points (bps) cut in the Federal Funds Rate (FFR) instead of the usual 25 bps.

That how the sell-off started in the US

Next, we look at Japan.

Bank of Japan’s Interest Rate Hike:

The Bank of Japan unexpectedly raised interest rates to the highest level in 15 years.

As a result, the Japanese Yen strengthened against the US Dollar (USD).

I expect the USD will flip in the future as the $USDJPY pair is also in the wave 4 correction.

Geopolitical Tensions:

Iran vowed revenge for the alleged assassination of a Hamas political leader in Tehran.

This heightened tensions in the Middle East, with fears that Israel’s conflict with Hamas and allies could escalate into a full-fledged war.

In my TikTok video, “Can you predict the direction of the market based on Geopolitical war?”

The best is to follow the market’s roadmap. “Global Market Report 3 - Aug 2024 edition”

Investor Behavior:

In times of uncertainty, investors often become fearful and withdraw their funds to secure profits. However, what many fail to realize is that such moments can present the best investment opportunities.

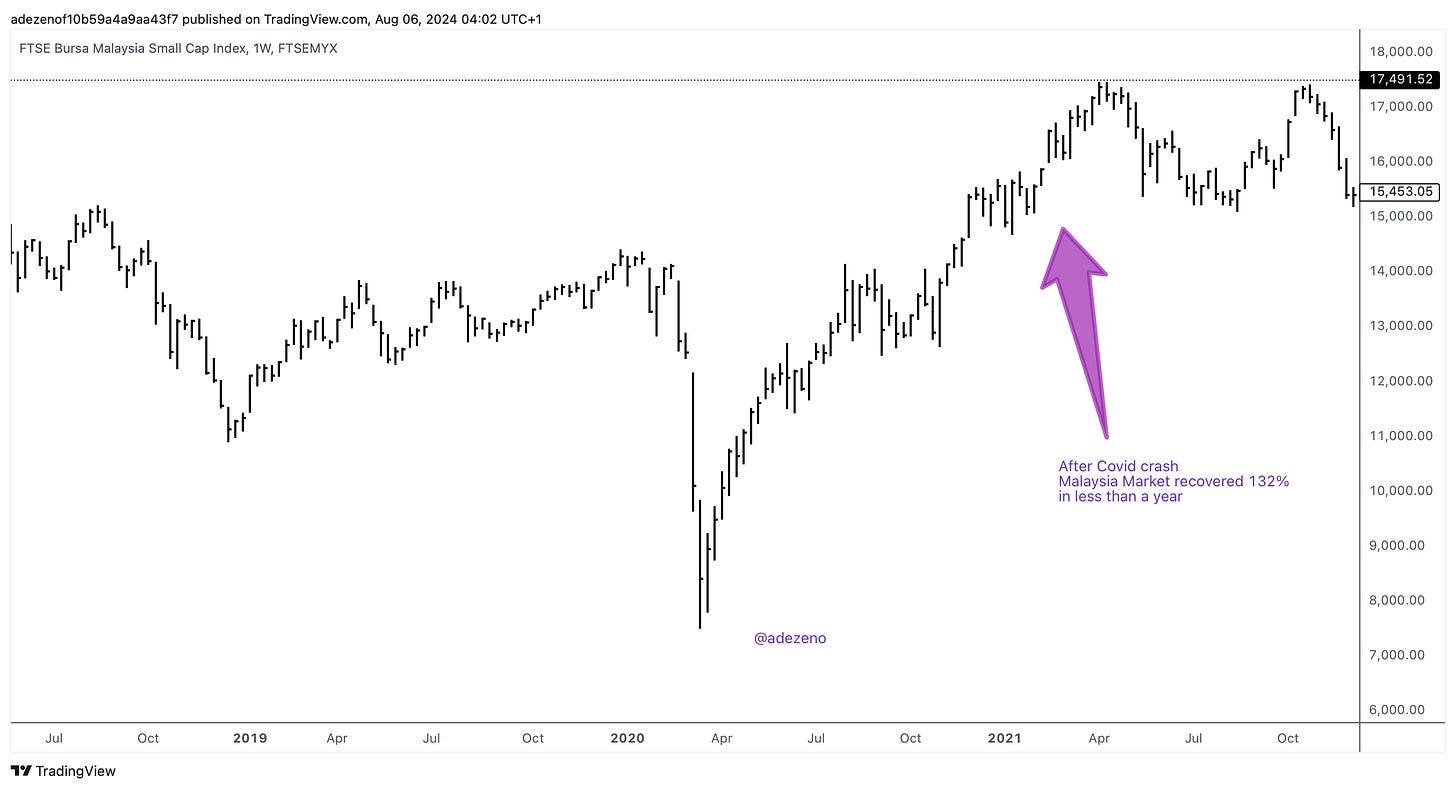

A prime example is the 2020 COVID crisis, during which Malaysia’s small-cap market experienced a significant crash, plummeting by 45%

Many people fear and withdraw their investment. But see what happens after this?

Malaysia Still Boleh

Malaysia’s Domestic Economy:

Malaysia’s economy has shown progress.

Data points, investments, tourism, and consumer spending remain resilient.

Consider accumulating fundamentally sound stocks with upside potential after the initial market reaction settles down.