Weekly Market Rollup Week #2 Nov 2021

Squid Game 2, Elon+Tweet=Tesla -15%, Li Ka-Shing Bets Hydrogen, China Shot US carrier, TSMC Vs Tencent, Airline + Casino Shares 🚀, EM Small-Cap = King 🤴🏼of 2021, Universal Music = Ape NFTs.

Great Day investors,

To start the week, Squid Game Series will be back for another round- Seasons 2 due to high demand.

Meanwhile, Viral Squid Game Cryptocurrency Crashes 100% In Minutes from $2,861 to a penny after Founders Reportedly Run Away With $2.5 Million. The Squid token skyrocketed as much as 310,000% since its launch launched on October 20.

_______

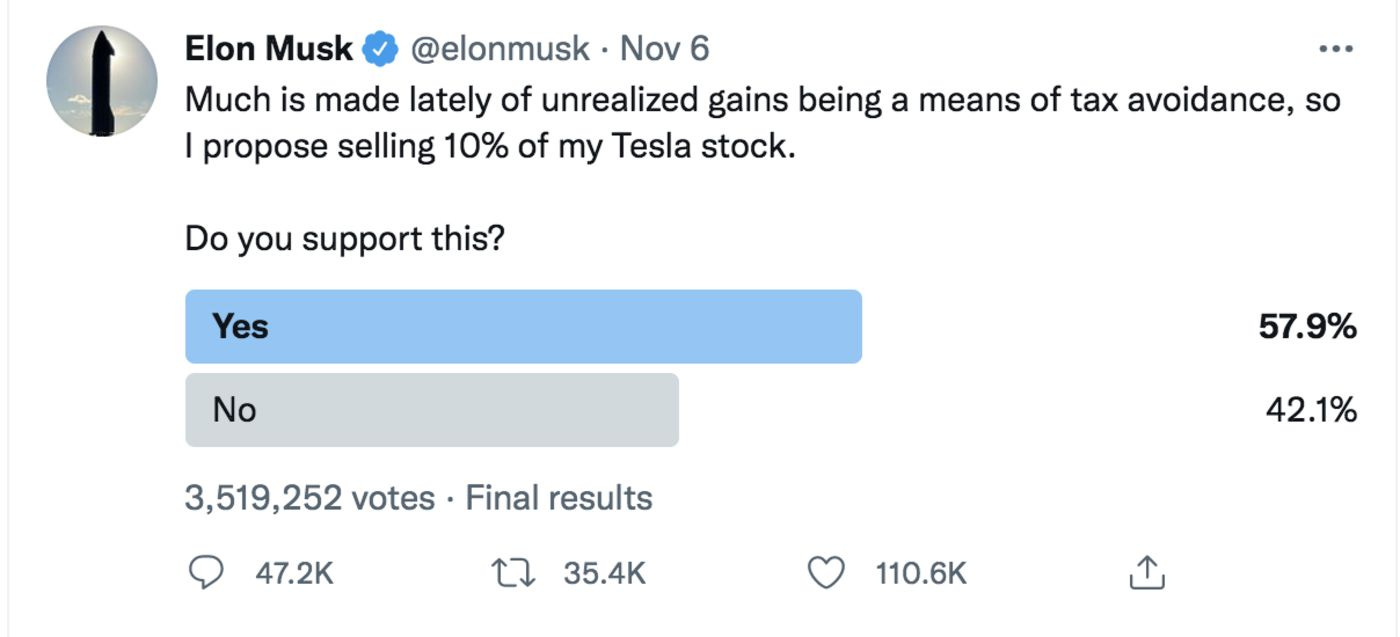

Tesla Fate is decided over a tweet.

Elon Musk's social media followers said the Tesla chief should sell 10% of his shares in the company, a stake worth roughly $21 billion.

Teslas stock is down 15.4% this week as the result of the Twitter poll. In addition, Elon Musk sold $5 billion of Tesla stock this week.

Before we start, apologies, too many charts today. Feeling nerdy, haha. 🤓

Remember to subscribe for free 👇🏼. Weekly news delivered Directly into your E-mail.

1: The Green Future

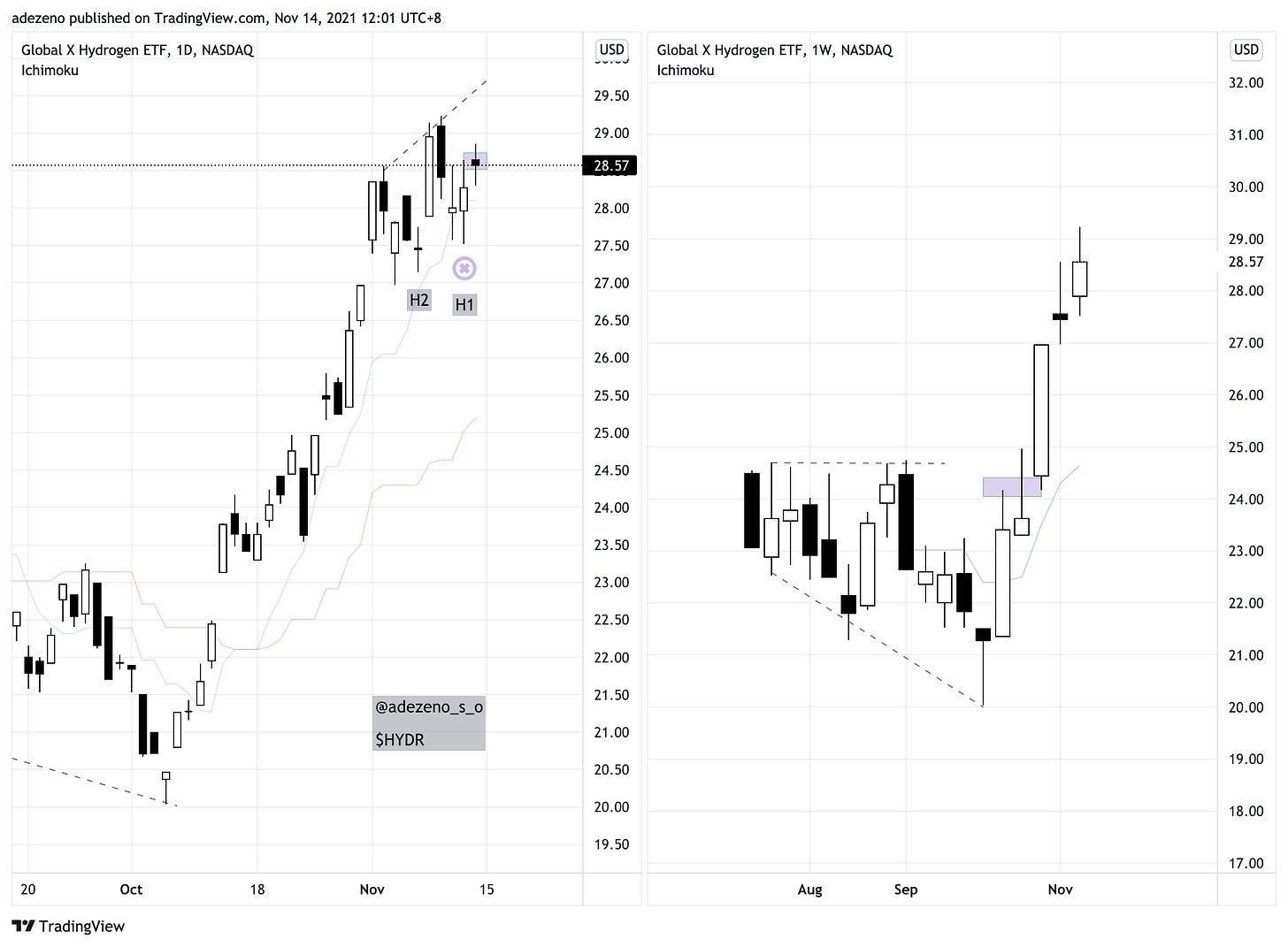

Li Ka-Shing Bets On Hydrogen

Li Ka-Shing made his fortune in plastics, logistics, and oil during his career. Now the billionaire and his family are increasingly betting on renewable energy.

Earlier this year, CK Infrastructure Holdings Ltd (an investment firm run by his eldest son Victor) bought stakes in Syzygy Plasmonics and H2Pro, two producers of the gas, as well as a startup for powering airplanes with it.

The firm also recently invested in the hydrogen private equity fund HYCAP

Technical:

daily: outside bar + H1. but with a bad follow through bar closing on Friday. a potential top wedge forming.

weekly: nice breakout from the base.

2: China The Asia Dragon

China Uses Fake U.S. Aircraft Carrier for Missile Target Practice

The Pentagon has voiced concern that China is expanding its nuclear weapons capabilities faster than ever. (this was covered in last week's newsletters). Many in the U.S. military establishment are also concerned about China’s investments in advanced missile technology.

In recent months, China-U.S. ties have been quietly improving, but the two nations are sparring over Taiwan, and tension has increased.

_______

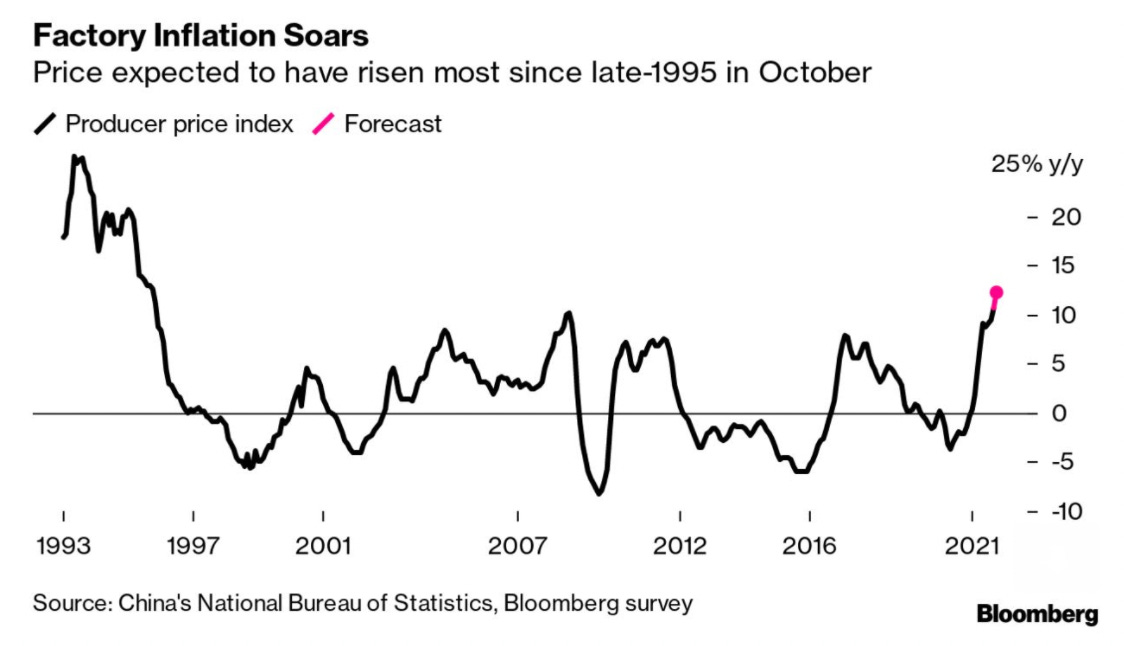

China PPI on steroids.

China's producer price index probably hit a quarter-century high of 12.3% in October. Thanks to the rising cost of oil, coal and steel rebar surged amid a power crunch in china.

Factory inflation raises faster than the Consumer price index. (below)

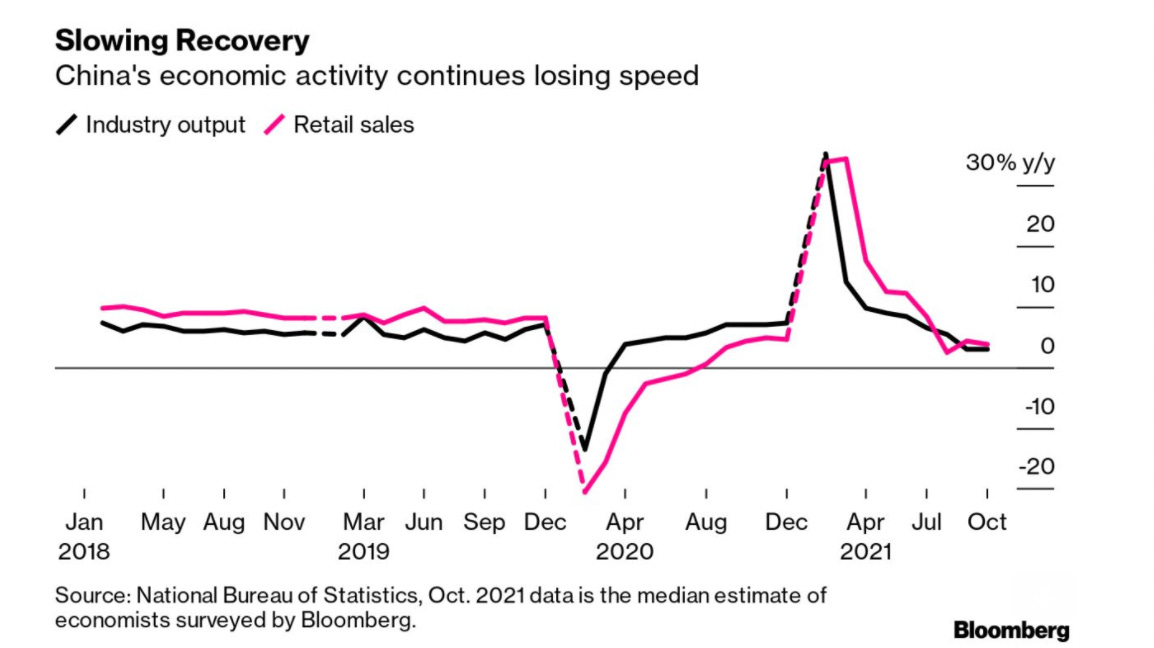

Sign of weakness.

3: Asia, truly Asian

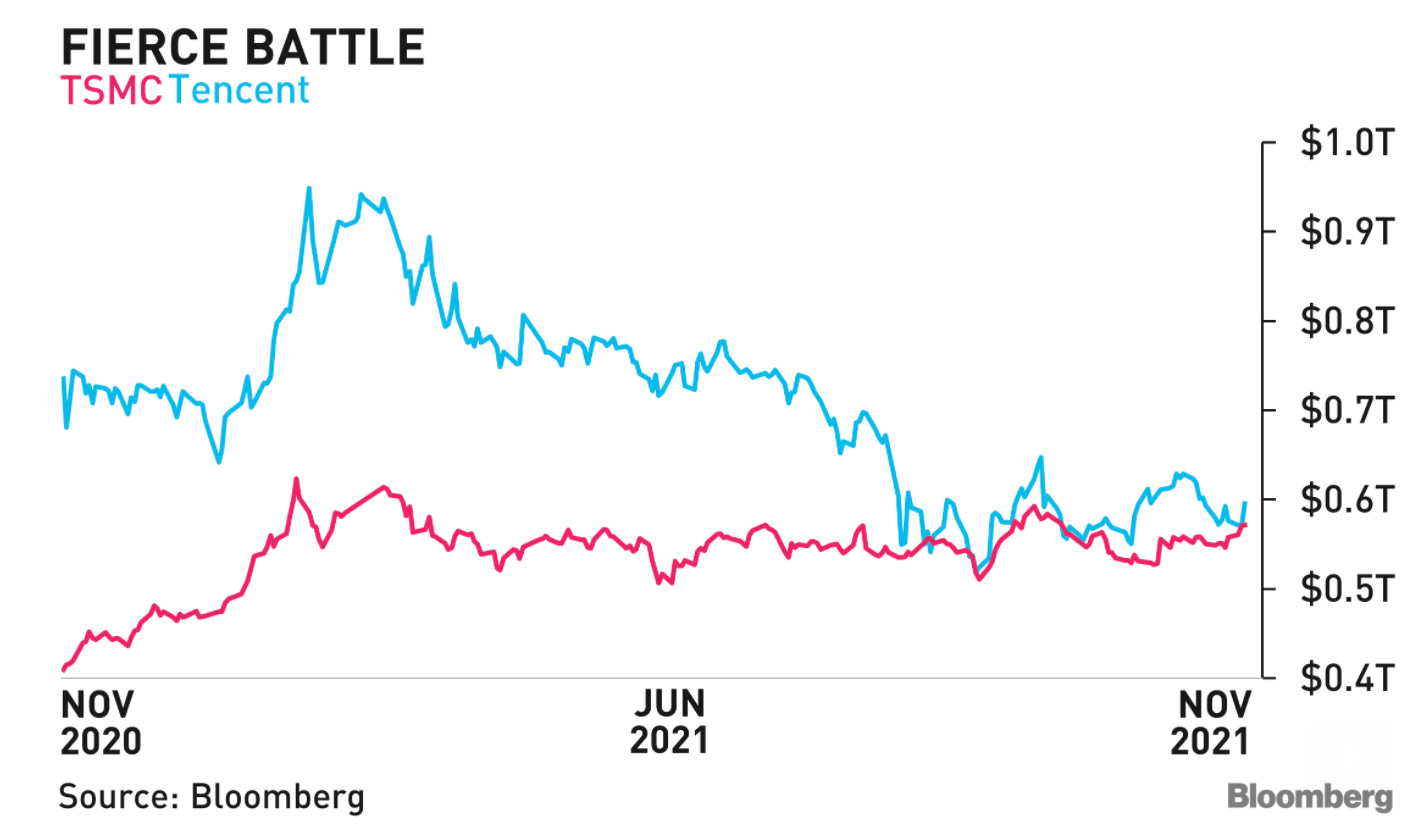

Crowning Asia's biggest company. China vs. Taiwan.

Who will win eventually?

Chinese tech giant Tencent's market value of $596 billion.

World top Semiconductor company TMSC market value of $572 billion

4: Freakonomics

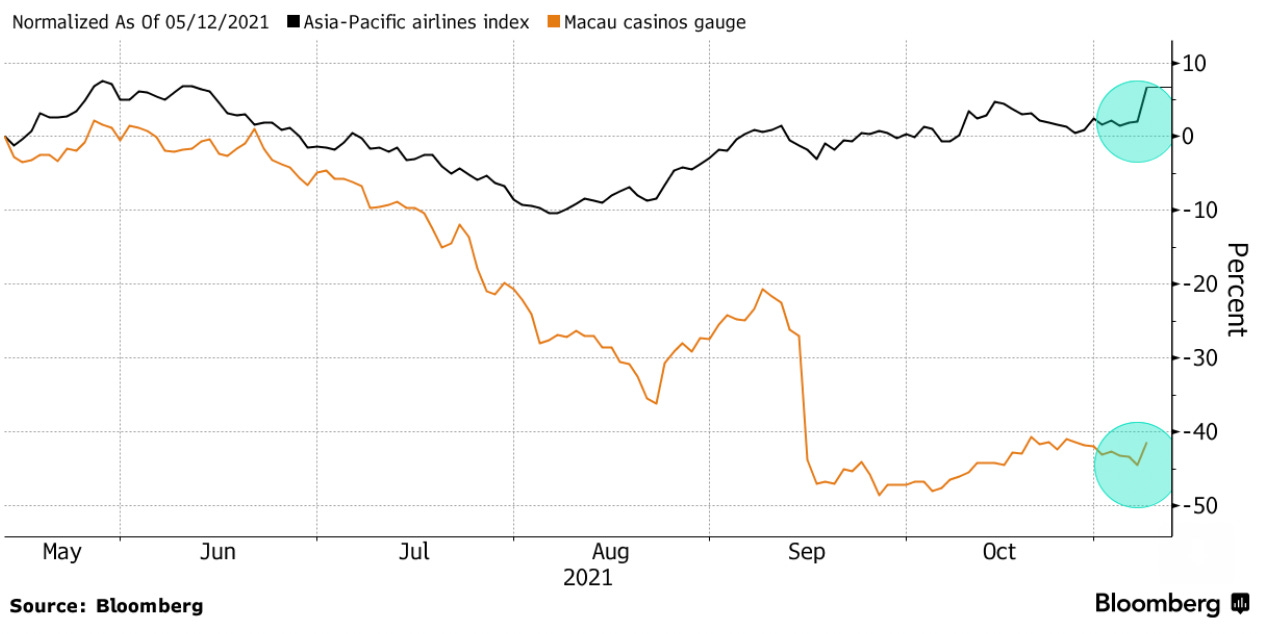

Reopening The World

Alines & Casino Share jumped in Asia (on Monday ) after News of Pfizer's Covid-19 Pill.

Above is Pfizer's daily chart. Enter limit order on the purple dotted line.

Technical. Small Breakout below $49 but need to be cautious of the possible wedge.

_______

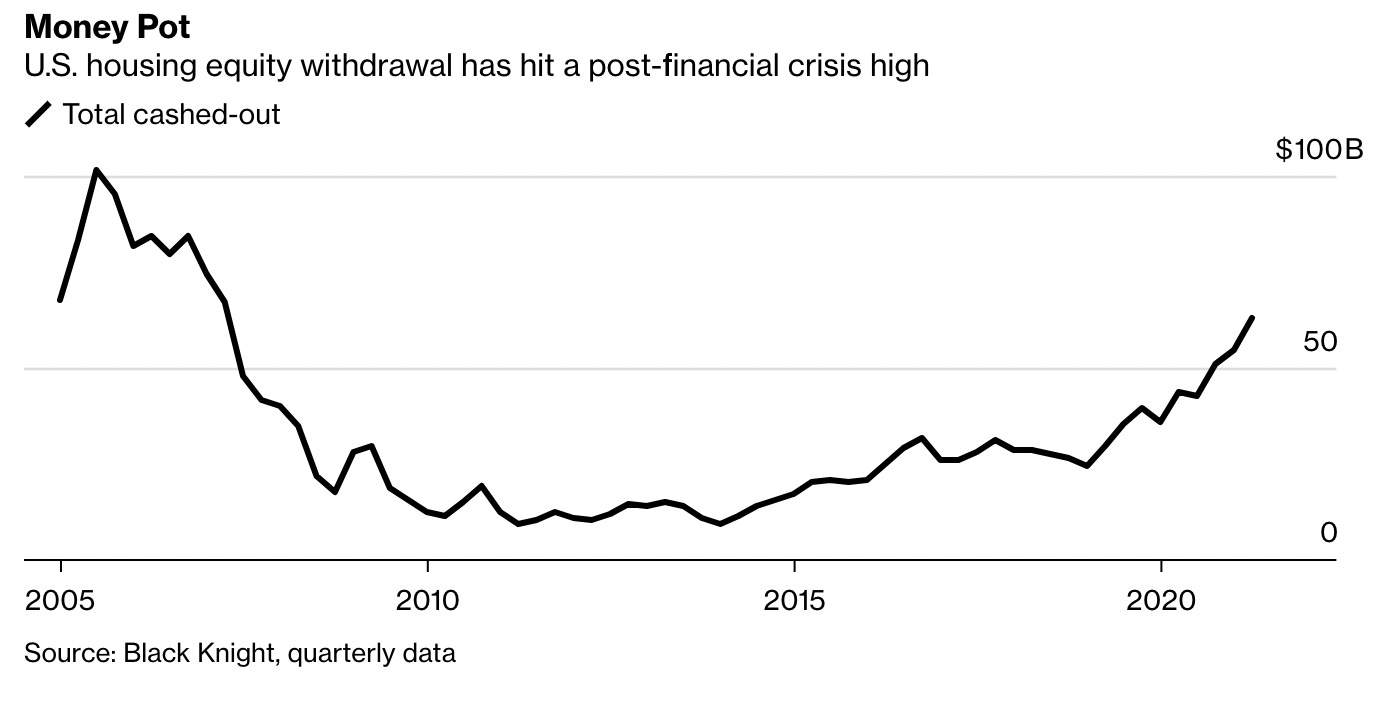

Red Hot Housing Market.

1 in 5 American Homeowners says they have pulled money out of their properties in the last year totaling $64 billion in the second quarter alone. Equity taken out are used for house renovation and paying out debts.

_______

Feeling expensive?

U.S. inflation jumped a more-than-expected 6.2% in October from a year ago, the fastest pace since 1990. Now Pressure is back to Fed to respond with an interest rate hike? which will then cause a catastrophic to the existing over-fuels US stock market

_______

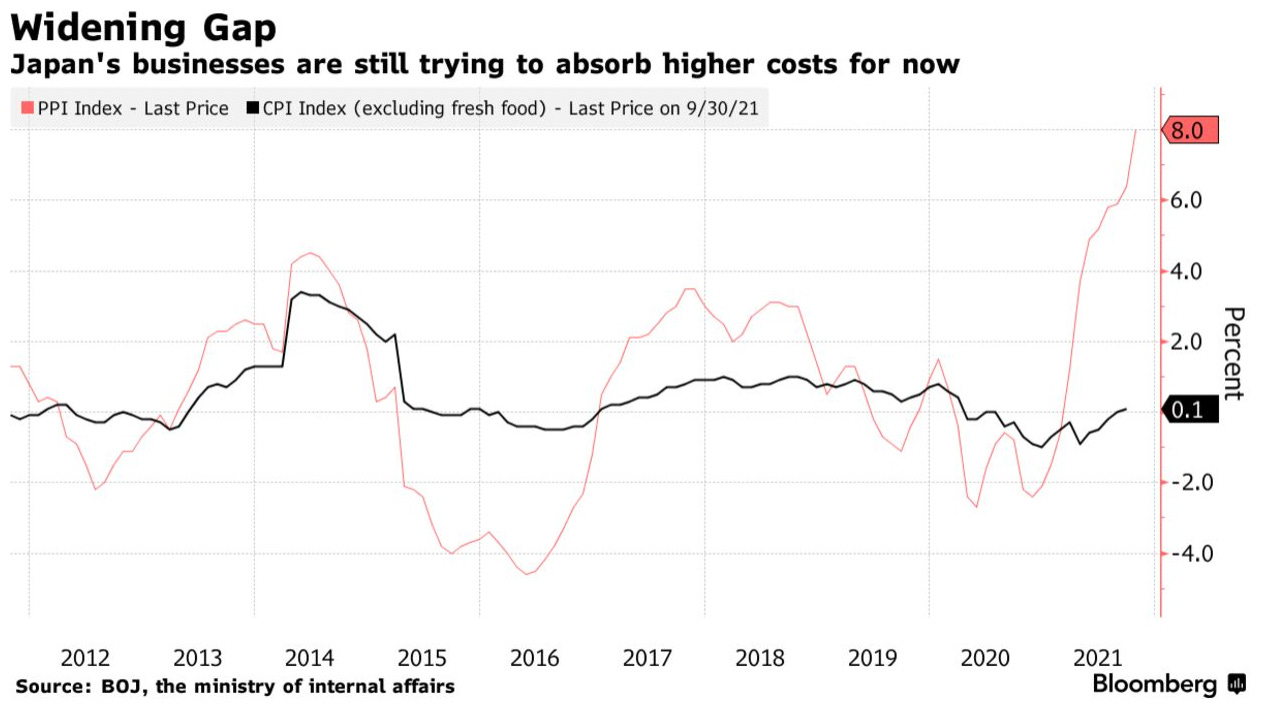

Soy Sauce Is Getting More Expensive in Japan.

Higher prices for gasoline and kitchen essentials are already squeezing Japanese companies and households. Costs for Japanese companies jumped to the highest level since January 1981. Oil and coal prices made a big contribution as they shot up 44.5%.

5: Market @ A Glance

Forget Bluechip; Emerging market Small cap is the king of this year.**Supply Chain:

6: Supply Chain

The world is desperate for Wheat - Leading to Food Inflation!

Wheat is used in everything from bread and cakes, to biscuits and bagels. Australia and Argentina Step Up as these two countries account for almost 20% of world exports on Wheat.

Shortage of the staple has deepened fears over food inflation.

Australia’s big customers mostly include Indonesia, Vietnam, China, and other countries in the Asia-Pacific region.

China has been showing an increased appetite for wheat, with purchases jumping 55% in the first nine months of 2021.

7: Wheels on Fire

Apple Hires Christopher “CJ” Moore, Tesla’s Autopilot Software Director, to work on self-driving cars.

_______

Rivian, an EV maker backed by Amazon, had a successful Stockmarket debut on Nasdaq. Stock Rosed by 30% above the offer price.

8: The New World: Crypto, Defi, Metaverse & Beyond

Bitcoin and Ether hit an all-time high. Bitcoin crossed $68,500 while Ether posted a more modest advance to above $4,800.

_______

Universal Music Group NV- world largest recording croup combing NFT & Metaverse

The company is working with collector Jimmy McNelis to convert four of his NFTs into a band called Kingship.

Kingship consists of four digital characters — three bored apes and one mutant ape — all part of an NFT. The company will record music for Kingship that it releases on streaming services. In addition, the “band” will perform and participate in video games, virtual-reality experiences known as the metaverse.

_______

AMC Entertainment Holdings Inc, the world’s largest theater chain, is exploring the creation of its own cryptocurrency. As a result, AMC’s shares surged 2000% this year thanks to an army of day-trading small investors.

________

Crypto is "HARAM" for Muslims in Indonesia

________

Coinbase CEO Says NFTs Could Be ‘As Big or Bigger Than Crypto Trading

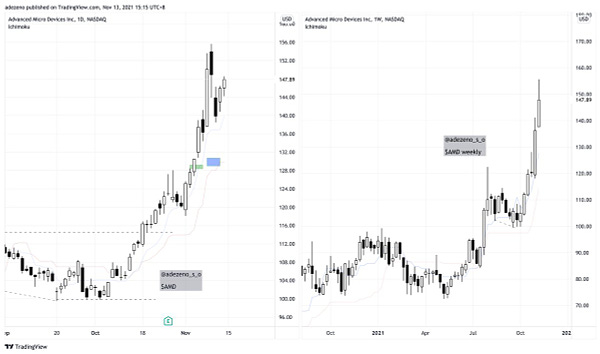

9: Stock On the move

Notes: Check out my 5 stocks on the move this week based on my actual portfolio in the tweet below.

Green = my entry

Blue = Stop Loss

10: Opinions

Personal Finance:

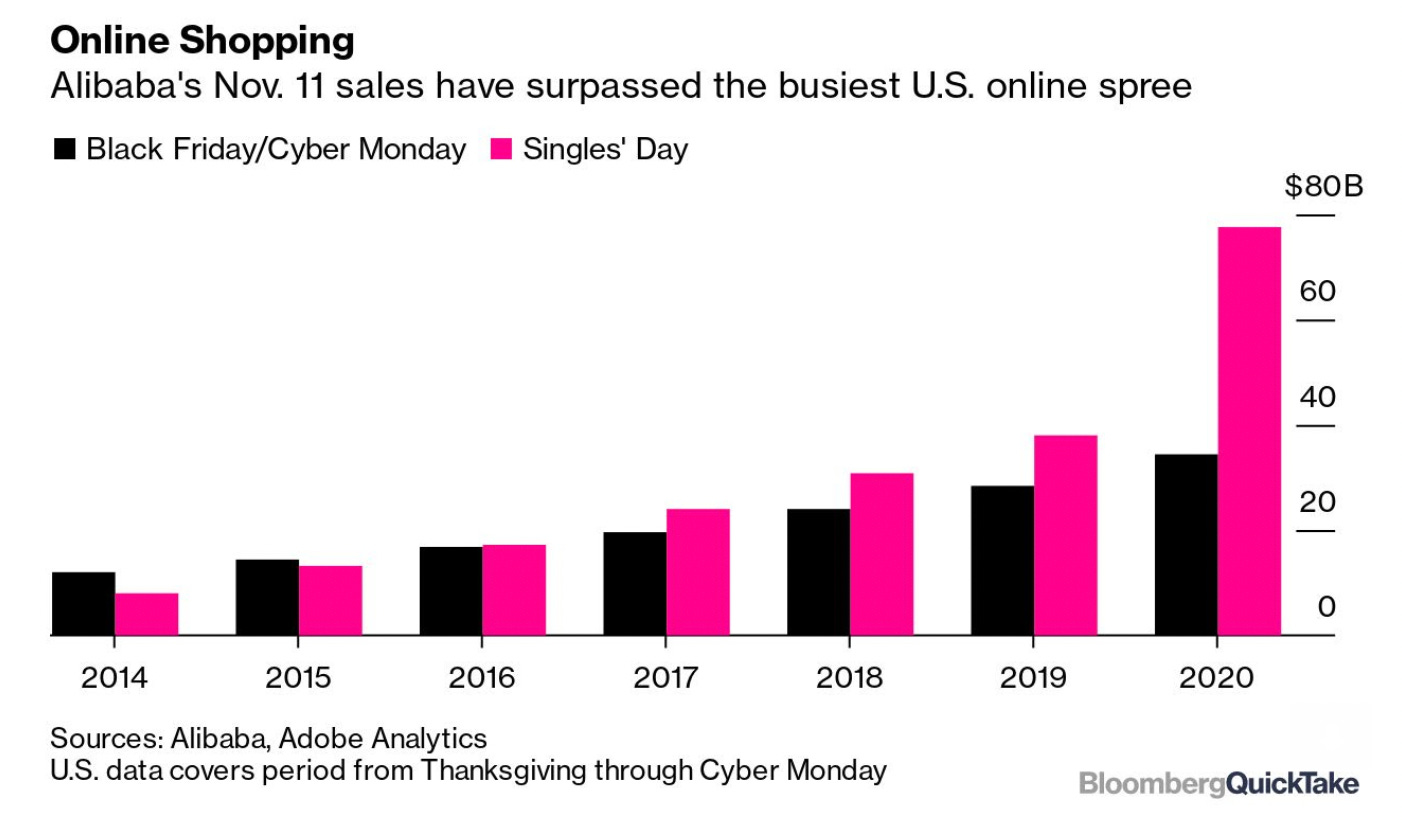

The 11/11 what so significant about this date? It’s not like it has some astrological universal power; maybe it does… but this is when Alibaba sales surpassed the busiest US online shopping spree.

Here is just a piece of sound money wisdom memes, not financial advice.