Weekly Market Rollup Oct Week #2 2021

How $1trillion fits in truck, FB Black Monday, Hydrogen the new green? China Blackout, Energy super inflation thanks to coal, Evergrande trading halt, Tesla short-seller cry😭, Mining in Malaysia mall?

Dear investors,

This week, a new guy joined the world's most exclusive club of individuals who hold fortunes above $100 billion. The man is Mukesh Ambani, Asia’s richest person.

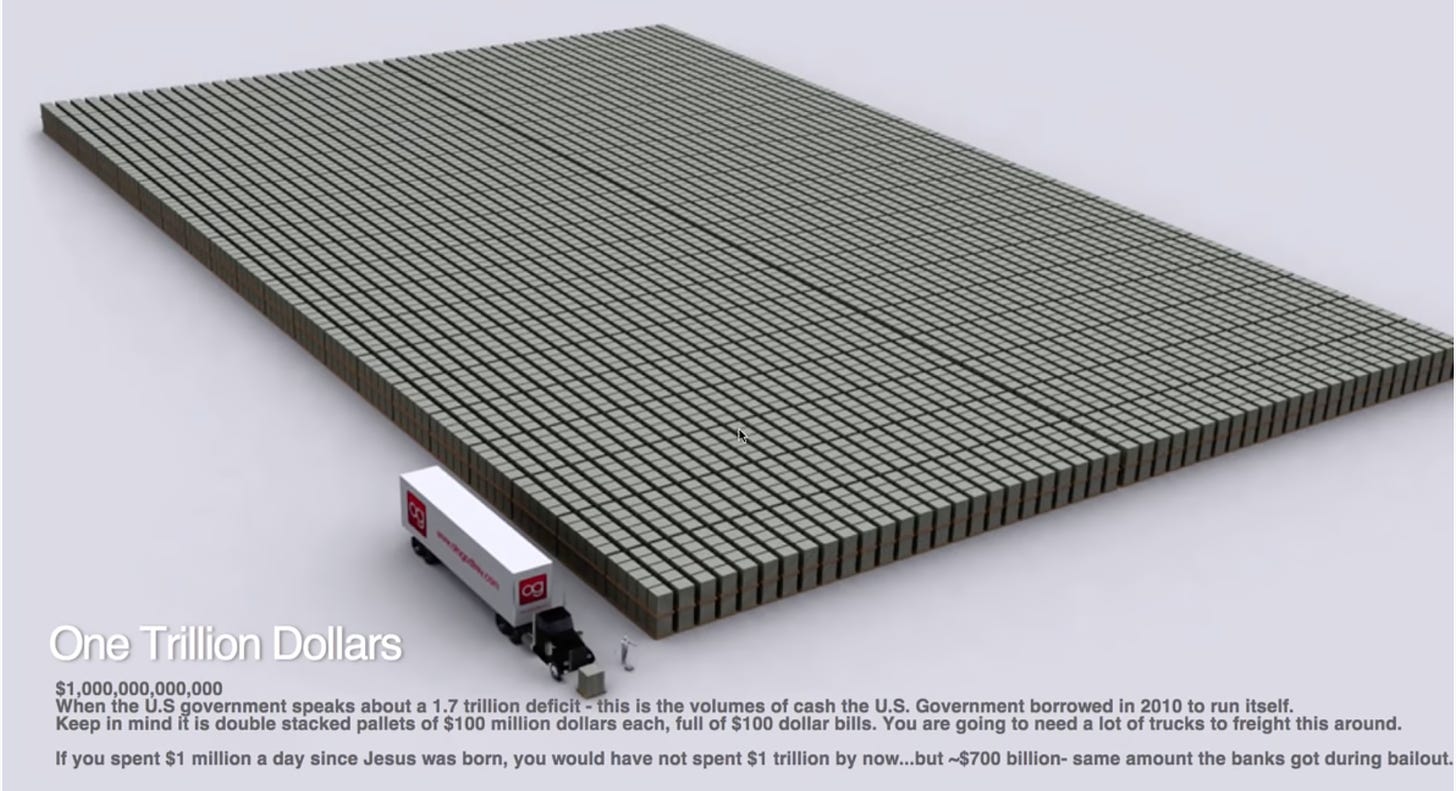

Let me put this in a better perspective. If you stack up the 100$ dollar bill of the top 7 wealthiest people globally, starting from Elon Musk to Sergey Brin, it will look like this.

Before we move on, Do you like what you see? Then, sign up for my “FREE” weekly newsletter. You will receive a weekly newsletter from me directly into your Email.

1: The Green Future

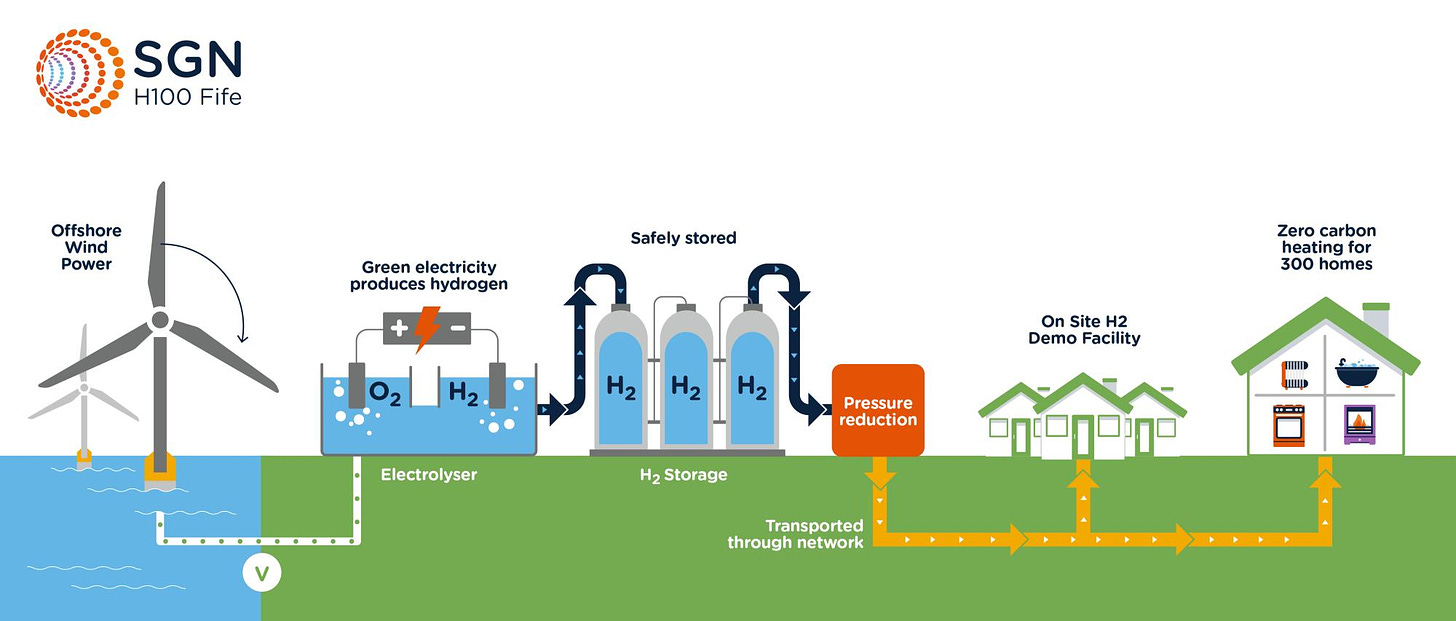

The world is waking up “Green Hydrogen” technologies could eliminate 1/10 of today’s greenhouse-gas emissions by 2050

When the oil shocks of the 1970s, humans start to look into hydrogen technologies, but it does not last long. Today, climate change has caused humans to once again look into hydrogen.

A dozen countries, including Britain, France, Germany, Japan, and South Korea, have a national hydrogen plan.

Japanese and South Korean firms are keen to sell cars using hydrogen fuel cells.

Some European countries hope to pipe hydrogen into homes.

Renewable energy generated from wind or sun is usually stored in batteries. But when energy is converted into hydrogen, it can be stored cheaply for long periods and converted to electricity on demand.

Maybe we can see one-day hydrogen should help make green power more reliable.

2: China The Asia Dragon:

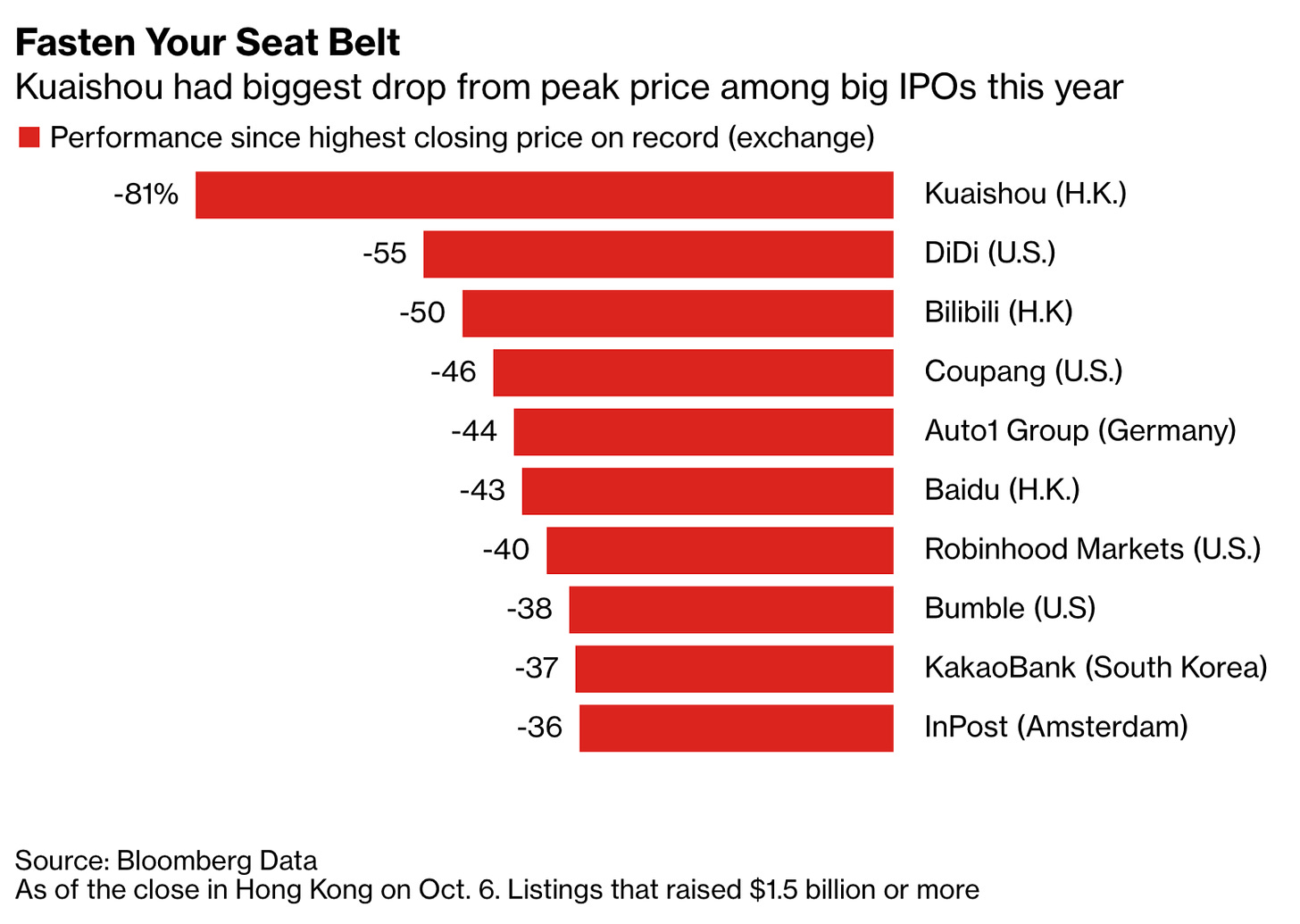

Crackdown had caused a meltdown for most Chinese IPO listed recently.

Kuaishoul (a TikTok rival) lead the packs with a -81% drop. Personally, I will try to avoid Chinese tech companies as market sentiment is very negative towards this sector.

The Chinese tech stocks nosedive from their peak in February this year. Technically we are yet to see any reversal. So stay at the sideline and watch china finish cracking everything before jumping in.

_______

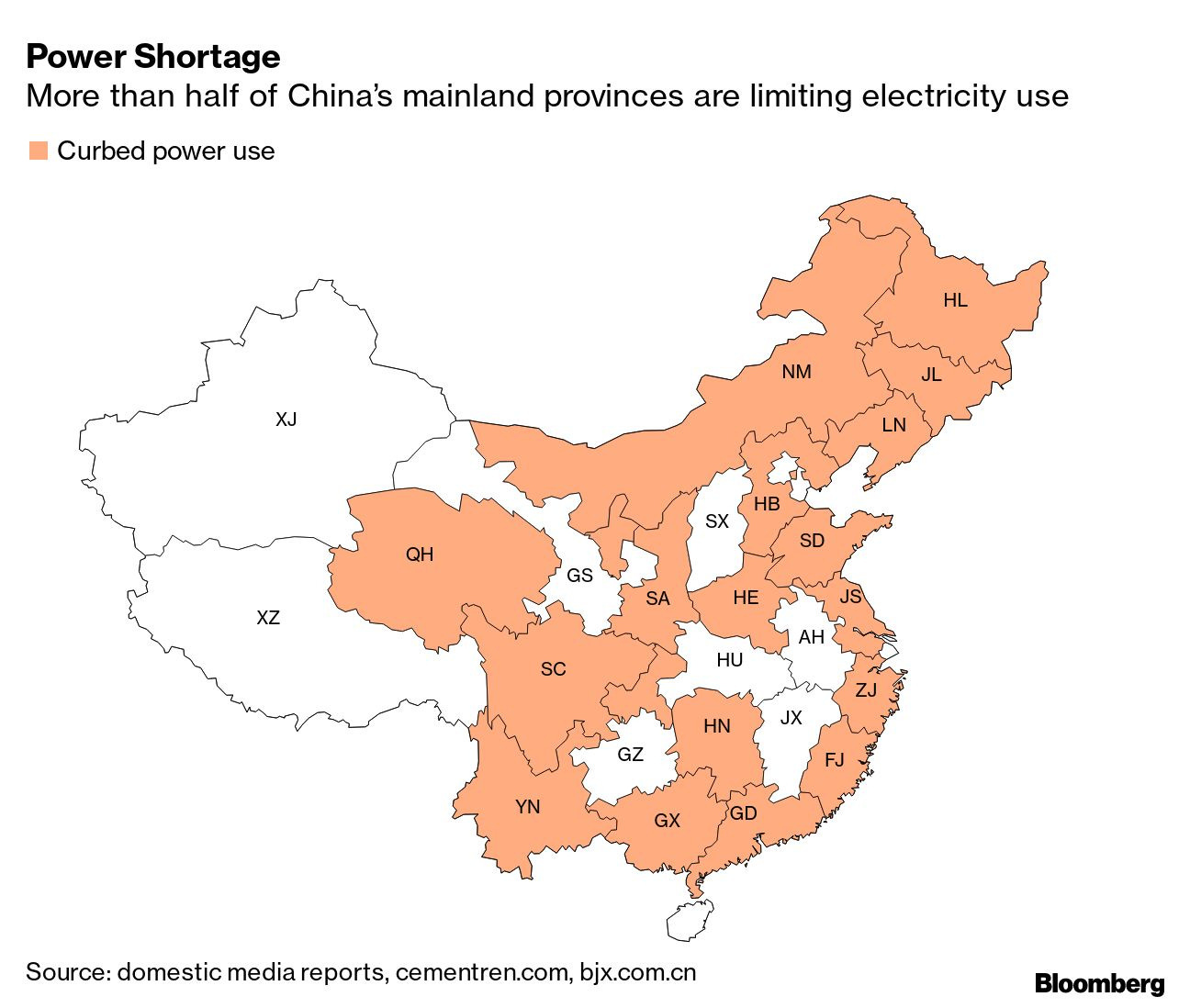

China Blackout Again

China, although the 2nd largest economy in the world, had experienced multiple power shortages. This happens due to unbalance development.

Among the affected are Guangdong, Zhejiang, Jiangsu, Jilin, where automakers have many factories in those regions. In addition, Toyota & Tesla came out and voiced their concern regarding this issue.

______

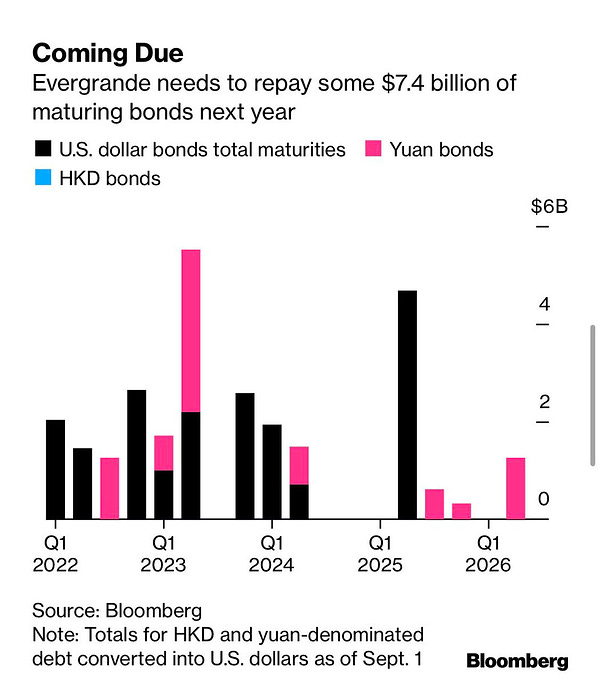

Evergrande's rival, Hopson Development, a Chinese state-backed media, said they consider taking a majority stake in Evergrande’s property-services unit.

Earlier this week, Evergrande, the world's most indebted company, was suspended from trading. → Click the tweet to read more.

3: Freakonomics

Inflation alert 🚨

The personal consumption expenditures index climbed by 4.3% in the year to August, well above the central bank’s 2% target.

Consumer spending in America rose by 0.8% in August from the previous month. Consumers spend less on cars and more on consumer supplies as car production slumps due to a shortage of semiconductors.

_______

The energy price hike in the Eurozone has caused inflation to 3.4%, the highest in 13 years.

Germany consumer prices rose by 4.1% in the same month, a 29-year high.

_______

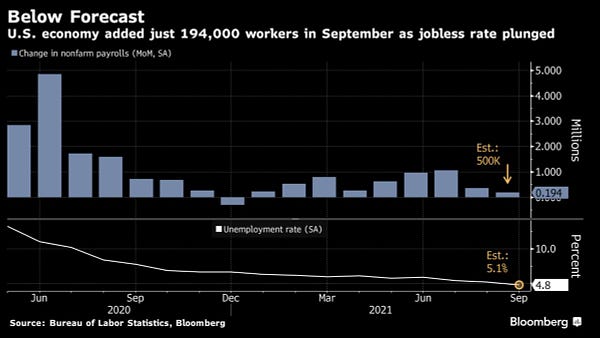

Workforce alert 🚨

4: Market @ A Glance:

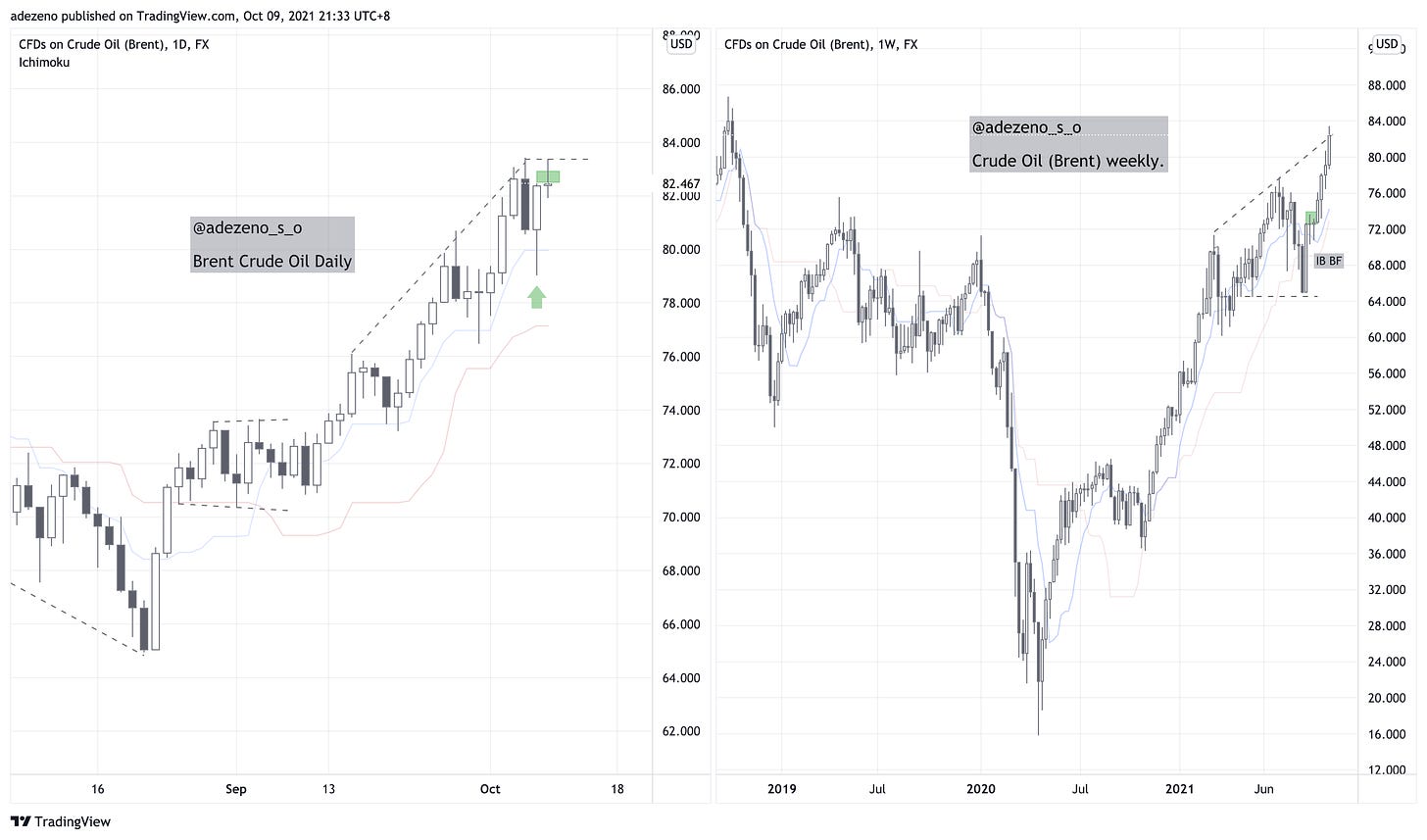

A roller-coaster week for the energy sector

Brent Crude Oil raised above $80, the highest since 2019 (in three years) after OPEC and its allies said they will slowly increase output, causing the supply shortage.

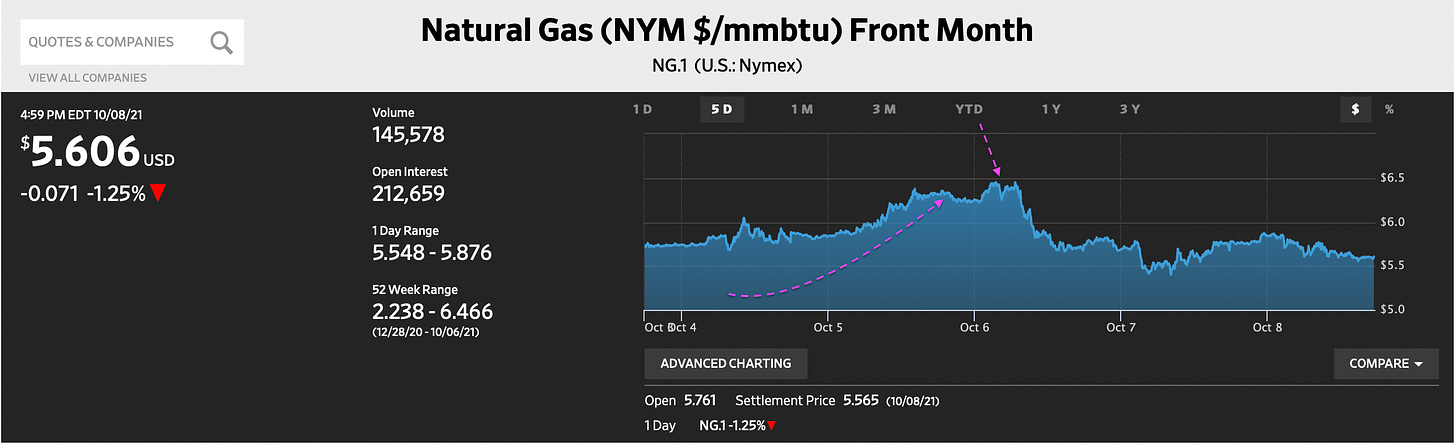

Natural gas front month futures jumped more than 60% in 2 days. However, the price reversed after the Russian president hinted they could supply additional gas to Europe.

Coal Shortage. China has no choice but to increase coal production to cope with its power shortage despite its effort in going green by reducing dependency on coal ( mention in my previous newsletter). As a result, half of India's coal-fired power plants are on alert for blackouts.

The coal price is rose by almost 300% in the past 12 months.

5: Wheels on Fire

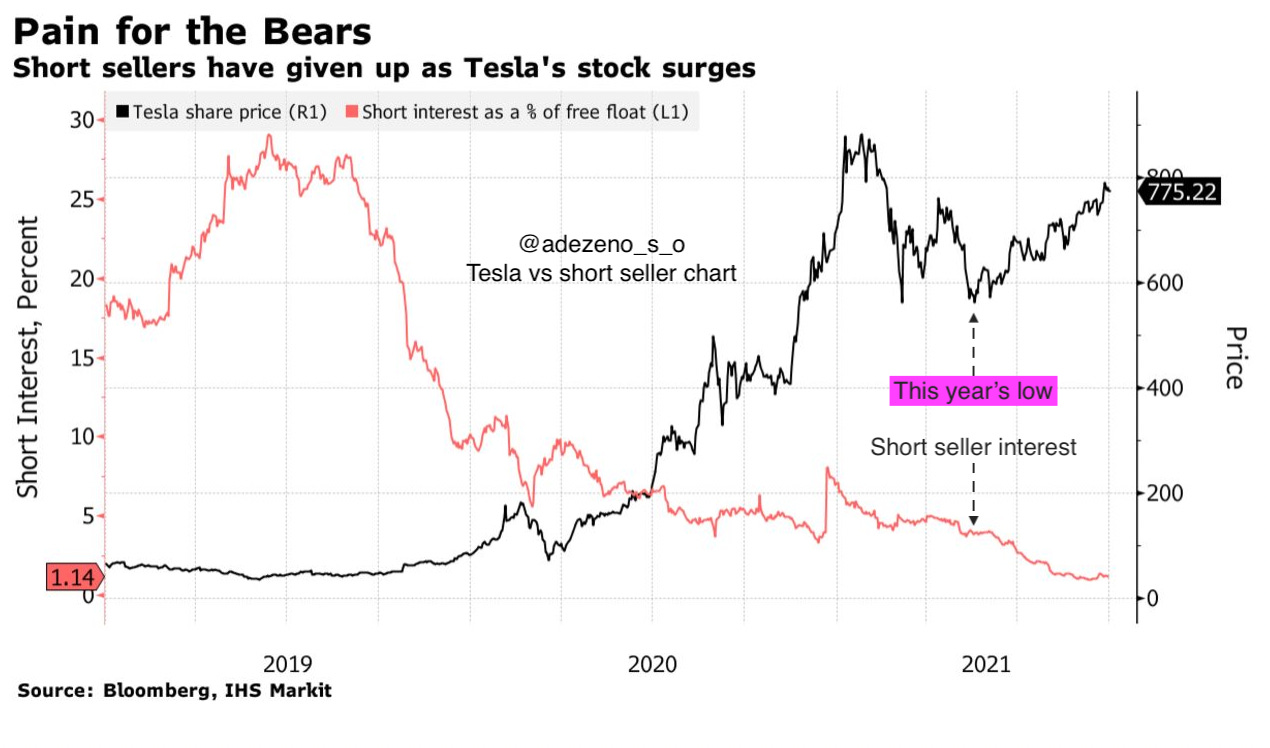

Tesla Short sellers are crying now 😭

The percentage of stock borrowed by traders to short Tesla stock has slumped to 1.1%. Many trader bets that Tesla unable to meet their car delivery and was betting for the stocks to fall get disappointed as Tesla share price continued to climb since March 2021.

Tesla, over the weekend, reported another record quarter for car deliveries. The pain for the short-sellers may be about to get even worse.

6: Tech Crunch:

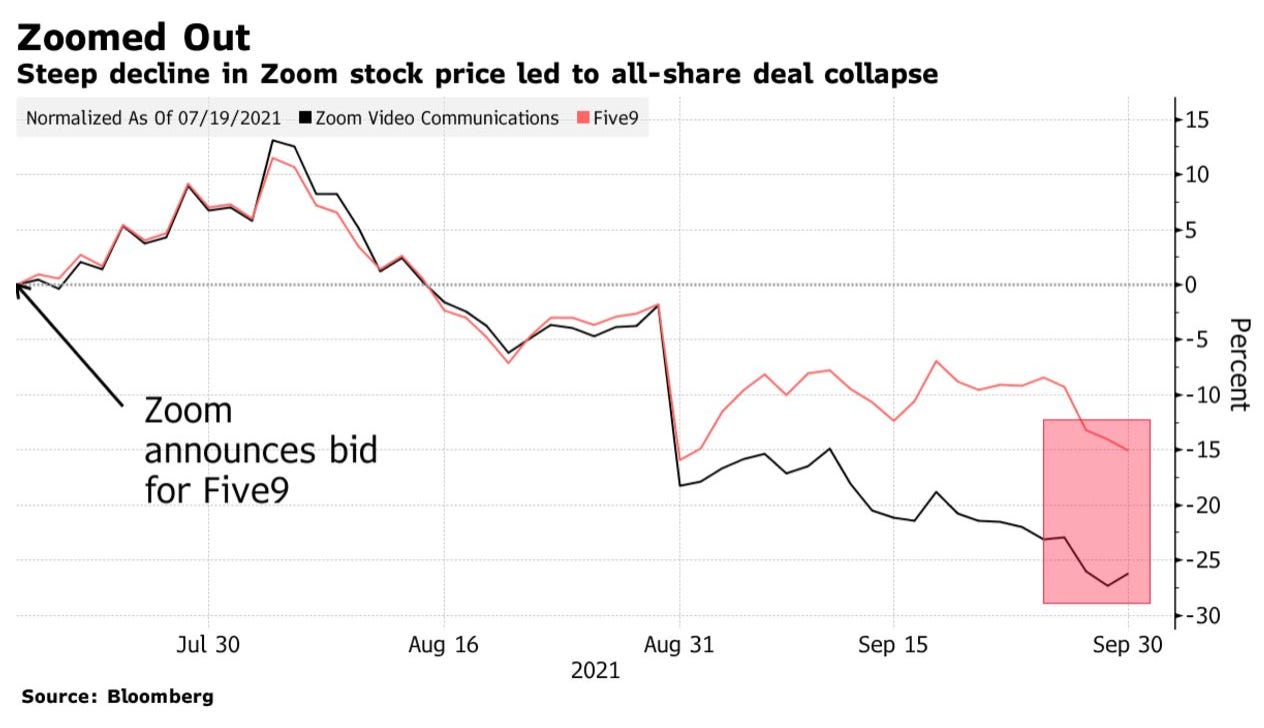

Zoom in to buy Five9, a call-center software provider, but Five9 says they can survive independently. The deal turns sour. Since then, both stocks have experienced a steep decline.

_______

7: Black Monday- FB, Insta & Whatsapp Down!

Read the 3 parts tweet below.

8: The New World: Crypto, Defi, Metaverse & Beyond

Compound, A Decentralised Finance (DeFi) platform, accidentally sent $89 million to a stranger.

Compound allows users to lend out cryptocurrencies and earn interest. So now the CEO of compound Begs the stranger to sent back the money.

A glitch caused the accident in the cryptocurrency platform. Unlike traditional finance, the DeFi platform doesn’t need a bank as an intermediary to administer the transfer. Instead, DiFi relies on “smart-contract” - a mathematical program that runs everything on the blockchain.

*note: the idea behind Blockchain is to have a fair decentralise system accesible to anyone, runs buy code and fallible humans, governs the system. Bacause human are subject to bias

To me, DeFi is still in its infancy. The Code that runs the blockchain might not be perfect for now; we will go through many hurdles - but guess what? All great achievements are paid for with sweat and tears.

_______

Malaysian mall and property developer Hatten Land Ltd - into crypto & NFTs

Hatten Land announced a deal with Singapore Myanmar Investco Ltd (SMI). to jointly explore business opportunities in crypto mining activities

Hattan Land will install and operate at least 1,000 crypto mining machines at properties owned or managed by the company in the states of Malacca. (all properties has a combined built-up area of more than 6 million sq feet) saying, “operations will improve the utilization and in turn enhance the profitability of our malls.”

Notes: at the time of this writing cryptocurrency mining isn’t prohibited under Malaysian laws.

9: Stock On the move:

Tesco: Operating profits in the first half of the year reached £1.3bn, a 29% increase on a year earlier.

Technical: Strong supprise bar close above 2020 high - Market Always in long. (puple dot)

Thank You for reading.. have a great week ahead. 😎