Weekly Market Rollup Aug Week #4 2021

90's Dot com bubble, China Ban extra working hour, Apple finally listen, Inflation is real, Malaysia Cabinet Shuffling = new hope? Visa buys Punks, China A-share is here. $POWI, $SKY to the Mars.

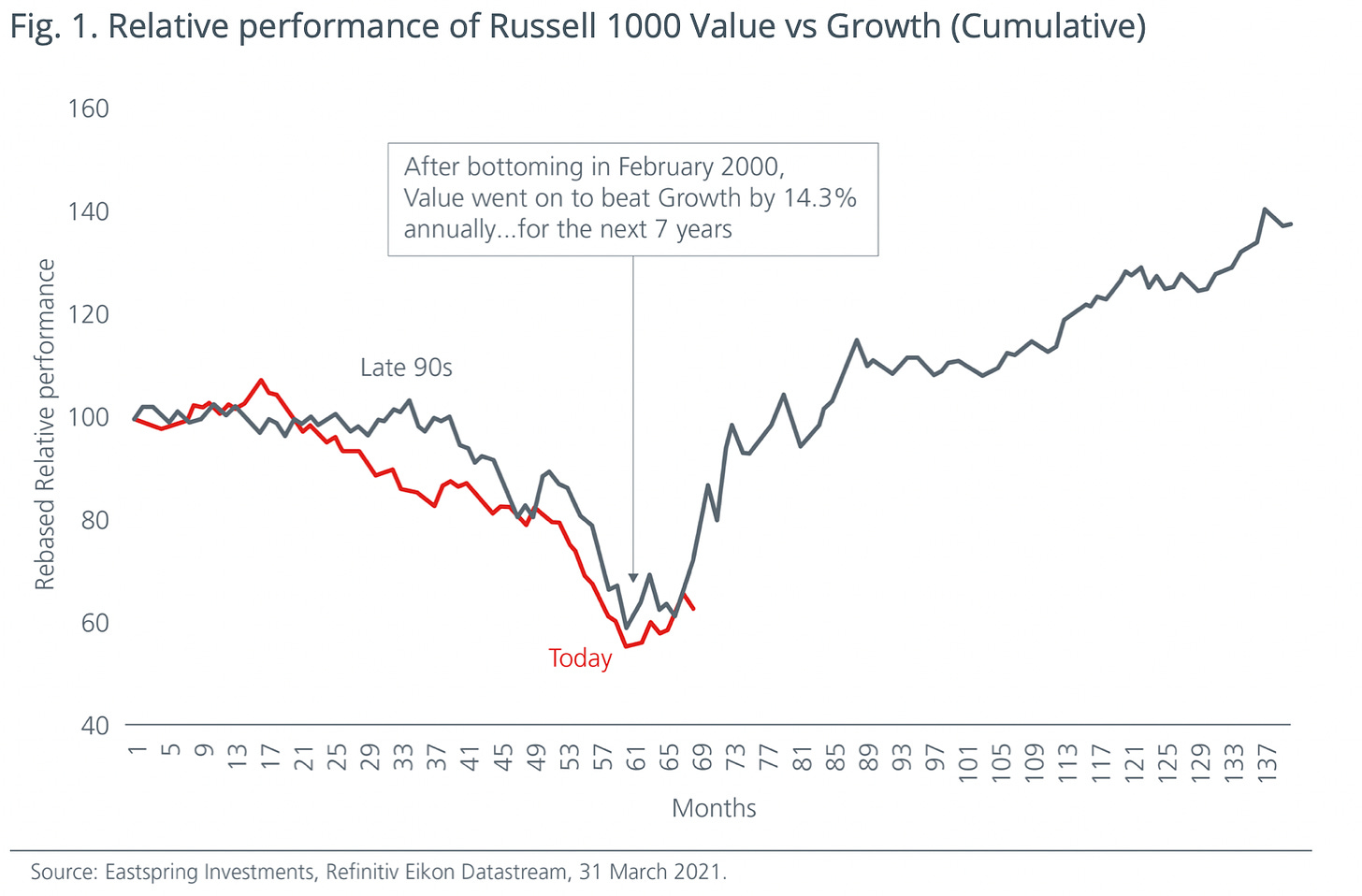

Can we see a recovery like in the late ’90s after the Dot Com Bubble?

The inability to spend over the last 18 months has resulted in historically high levels of savings which we expect to lead to increased consumer demand in the short term + unprecedented fiscal and monetary expansion plans by governments around the world.

How to read the chart in Fg. 1?

The line chart represents Value stocks vs. Growth stocks.

If the line chart pointing down = Growth stock Stronger than Value stocks.

If the line chart moving up = Value stock is stronger than Growth stock.

Eastspring investments saw the long-term outperformance of Value equities. In fact, it may be following a similar pattern from the late 90s and into the 2000s. (Red line tracking the grey line).

In the past 3 months, we have seen the recovery are lead by sectors that bode well with Value equities. In addition, strategies that have a disciplined Value approach have outperformed in the last six months.

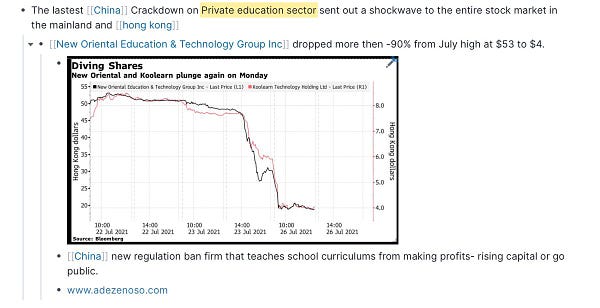

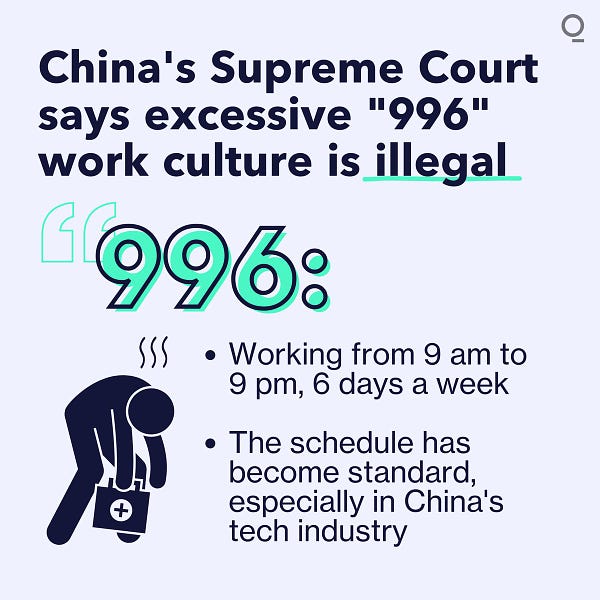

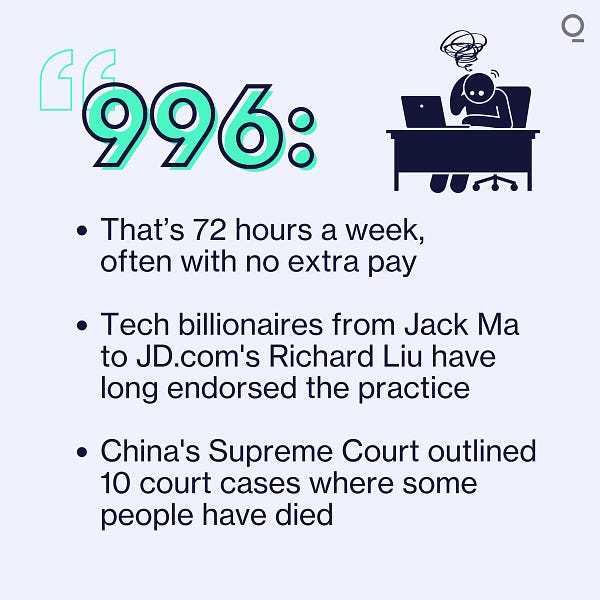

Introducing China’s style of ESG (Environmental, Social, and Governance).

It is not for the faint-hearted & paper hand investor.

China’s the world's 2nd largest economy intention to reform the after-school tutoring had caused a -90% drop to some education-related stocks last month.

The Chinese government wants to ensure that students are getting enough rest, reduce household spending on education & reduce inequality in the system where Poorer households could not afford these after-school sessions and seem disadvantaged in the quest for the higher grades needed to enter China’s top schools.

Further proof showing China is committed to change its socioeconomy

The policy enforced can be viewed as very drastic and inappropriate for capitalism; as China advances, it can help reverse or slow China’s declining birth rate & eventually will drive more sustainable higher-quality growth.

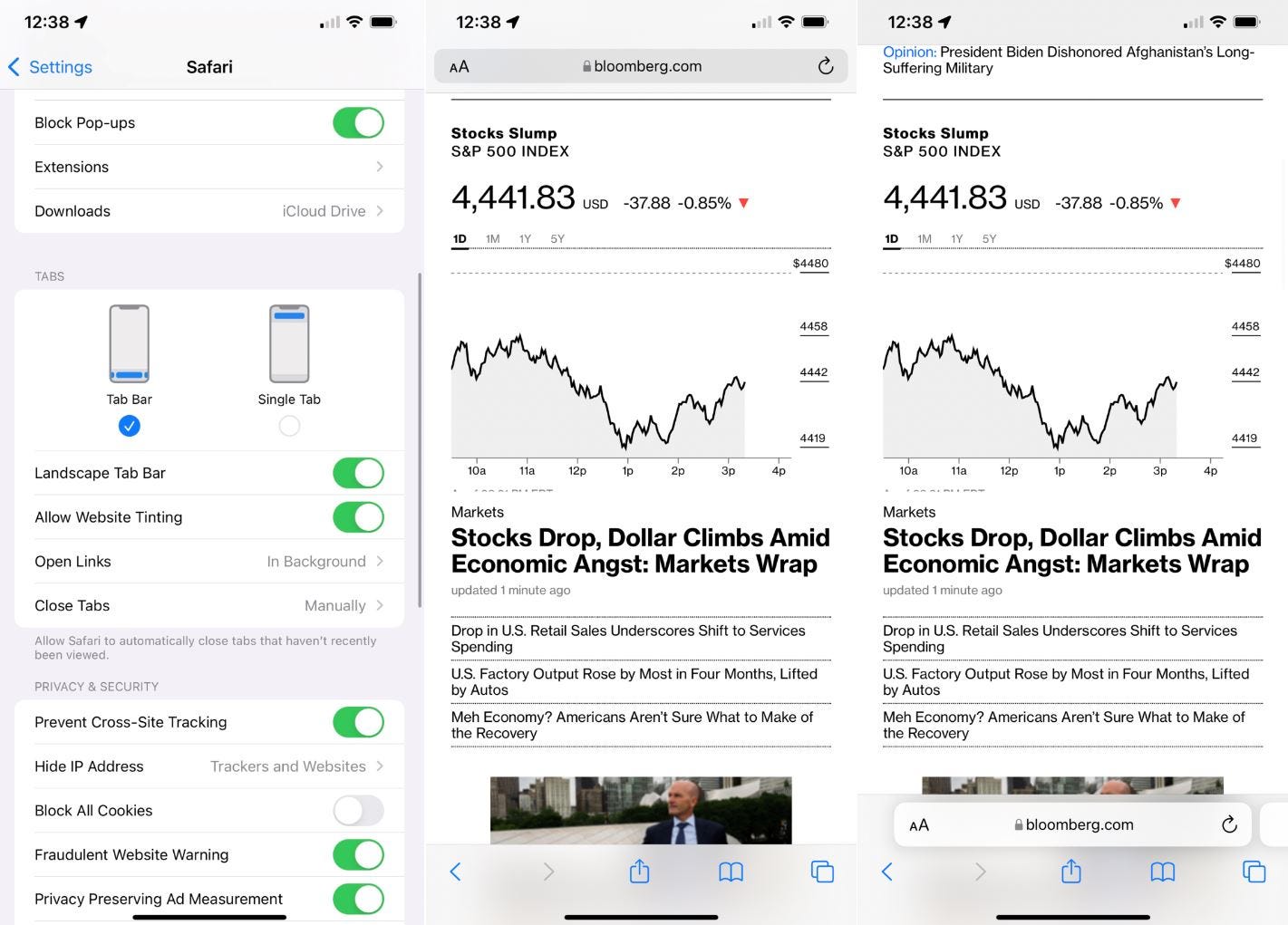

Apple finally listens to the consumer.

Steve Jobs used to say that consumers don’t know what they want and trust Apple to make decisions for them. That way of thinking has helped make Apple one of the most successful companies ever.

But that is changing. After many complain from apple users, they decide to make some of the biggest changes to the design of the Safari web browser on iPhone. It gonna look something like this.

Moving the address bar from top to bottom.

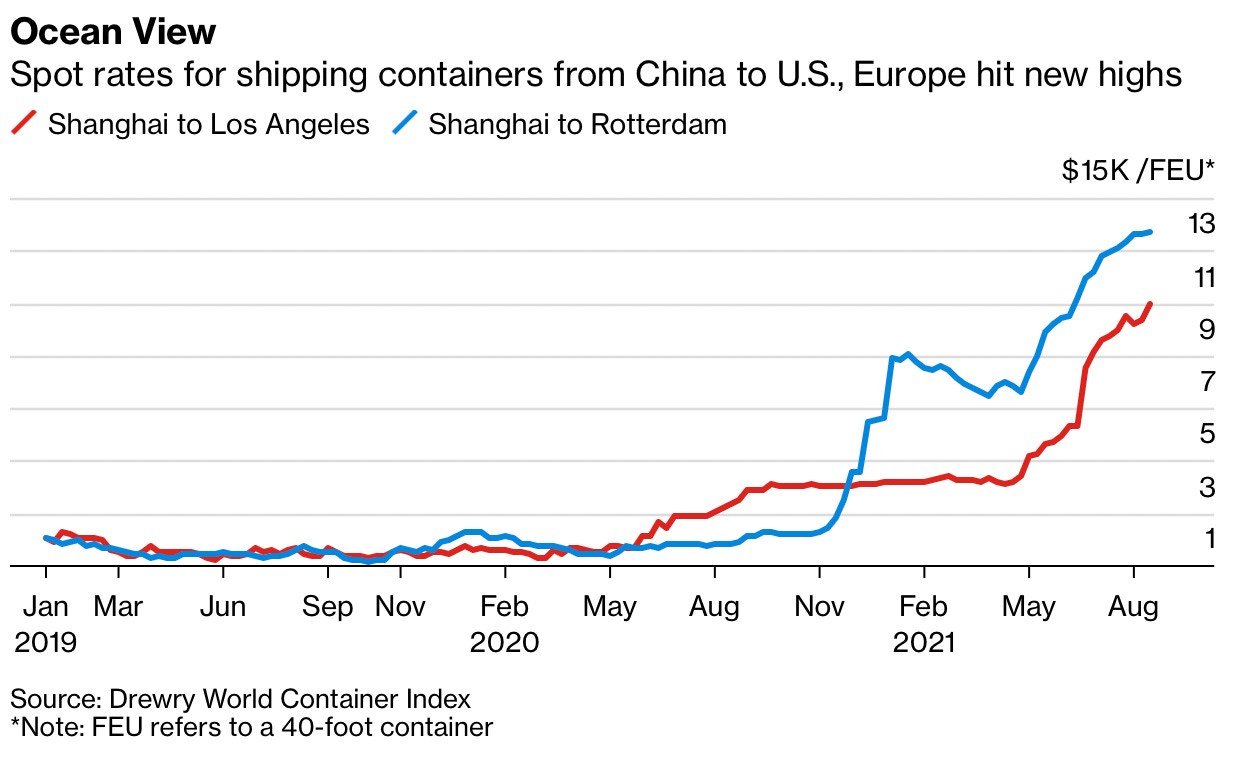

The World Economy’s Supply Chain Problem Keeps Getting Worse - Inflation Is Happening.

From a single Delta variant case, China decides to close part of the world’s 3rd largest container port at Ningbo for 2 weeks. This causes a huge material shortage around the world.

Manufacturers short of the key components are going on bidding war to get space on the vessel, pushing freight rates to records high!

The cost of sending a container from Asia to Europe is about 10 times higher 😱 than in May 2020

The supply chain problem causes a ripple effect from rubric cubes, coffee maker machines to crucial components like semiconductors.

When there is a demand for a product, and the manufacturer cannot keep up, it causes the price to skyrocket 🚀. For example, the cost of magnets used in the puzzle toy has risen by about 50% since March.

Vietnam, the world’s second-largest producer of footwear and clothing, the government has ordered manufacturers to allow workers to sleep in their factories to keep exports moving. 🤭

According to Port congestion and a shortage of container shipping capacity may last into the fourth quarter or even mid-2022

To conclude, Higher freight rates are the gasoline ⛽️ that feeds into inflation.

Malaysia Cabinet “Reshuffle” Bringing New Hope?

Malaysia's Prime Minister Ismail Sabri Yaakob has retained Tengku Zafrul Aziz as finance minister, Khairy is the new MOH.

If you recall, in my previous Weekly Market Rollup Aug week #3 2021 I did mention the Purple arrow -> is where we should keep an eye on the Malaysia market.

It is pretty much evidence that Malaysia Politics has brought some hope to the equity market, at least from the technical standpoint.

Malaysia Blue Chip

Malaysia Small-Cap

I’m expecting to see institutional & retail investors flock in both the blue-chip and small-cap sectors in the coming weeks.

**Eastspirng fund manager has been positioning their stock selection towards the economy recovered theme mostly in the value sector, as I mentioned at the beginning of this article, so stay tuned for more updates.

What Hot In Crypto World.

Visa’s Head of crypto said NFTs in the future for Retail, Social Media, Entertainment & e-commerce.

No doubt, Visa paid $150,000 for this piece of this pixel art collectible -Punk #7610.

Guess what the most expensive punk is?

Source <—read more here.

China A-Share is here!

As I promised last week, I’m going to reveal to you what China A-Share is. Eastspring lastest and

Please read here for a full summary of all 9 points why you should get a piece of this in your portfolio. -> Top 9 Reasons Why Islamic China A-Share Fund Is A Real Deal.

Stocks on the move:

*Green Box = my entry.

$SKY 21% gain in 28 days

$POWI 8.81% in 6 days.

Subscribe If you like this to be deliverd to your Email weekly. No hype just pure data!

ok until next week, see ya and have a great day!

#staysafe.