How much life insurance do you really need?

The Importance of Income Replacement using Term Life Insurance

Life insurance is for income replacement. - period.

Example:

I work, but my wife does not. We have two children.

Here are my financial obligations:

Monthly expenses for the family: RM5,000 (food, bills, etc.)

Remaining car loan: RM70,000

Remaining credit card debt: RM7,000

Planned education fund for each child: RM100,000

If I am no longer able to work due to permanent disability or death:

I want to settle the above debts using the Life insurance payout → Total: RM77,000

Then, I want to ensure an education fund of RM200,000 for both children.

Finally, I want to ensure RM5,000 per month for family expenses for the next 10 years. Calculation: RM5,000 x 12 months x 10 years = RM600,000

The total life insurance I need is RM77,000 + RM200,000 + RM600,000 = RM877,000

That’s a nice number! 🤣

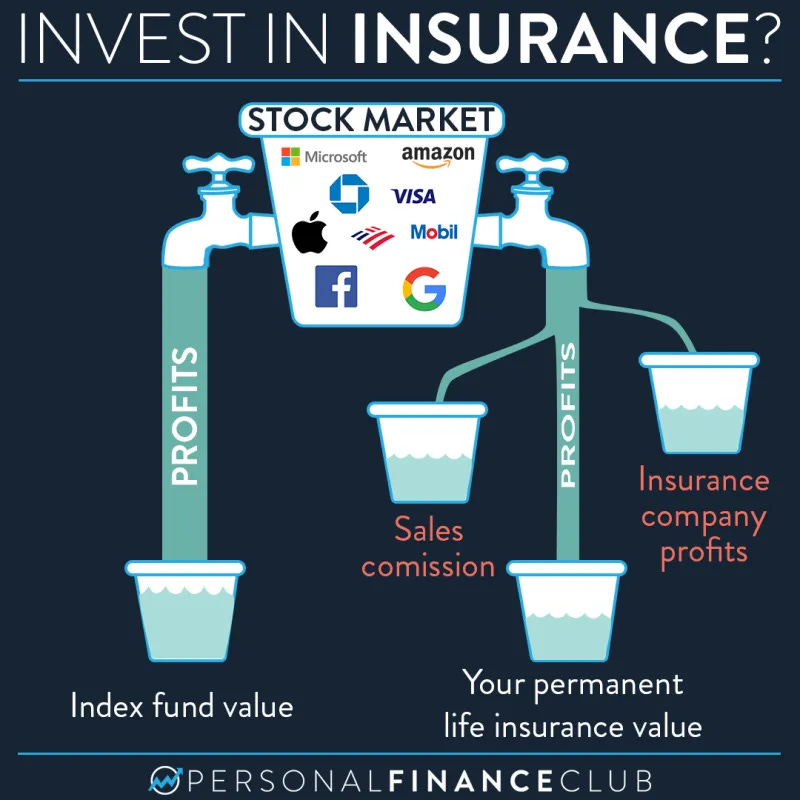

To get RM877,000, the best way is to get term life insurance because it is affordable and you can use the rest of your money to find a better yield return.

The concept of insurance, or Hibah for Muslims, is straightforward. It’s not about making money while alive, but about providing peace of mind for your family. If one day you are no longer with them, they will be relieved knowing you haven’t left behind debts or burdens