Bank Negara raised the overnight policy rate (OPR) twice this year.

1: 25 basis points (bps) to 2.00% (25 basis point is 0.25%) 11 May 2022

2: 25 basis points (bps) to 2.25% on 6th July 2022.

Why does Bank Negara Malaysia rapidly raise the interest rate?

Exports and retail spending indicators affirm the growth momentum while

The unemployment rate has continued to decline with higher labor participation and improving income prospects.

Additionally, the reopening of international borders on 1 April 2022 would facilitate the recovery of tourism-related sectors

However, BNM also sees the following risk

Weaker-than-expected global growth due to high inflation

Further escalation of geopolitical conflicts, (Ongoing Russia Ukraine war) and the risk of (China -Taiwan conflict)

Worsening supply chain disruptions. (caused by Shanghai lockdown early this year)

The effect of the Interest rate hike on Malaysia's stock

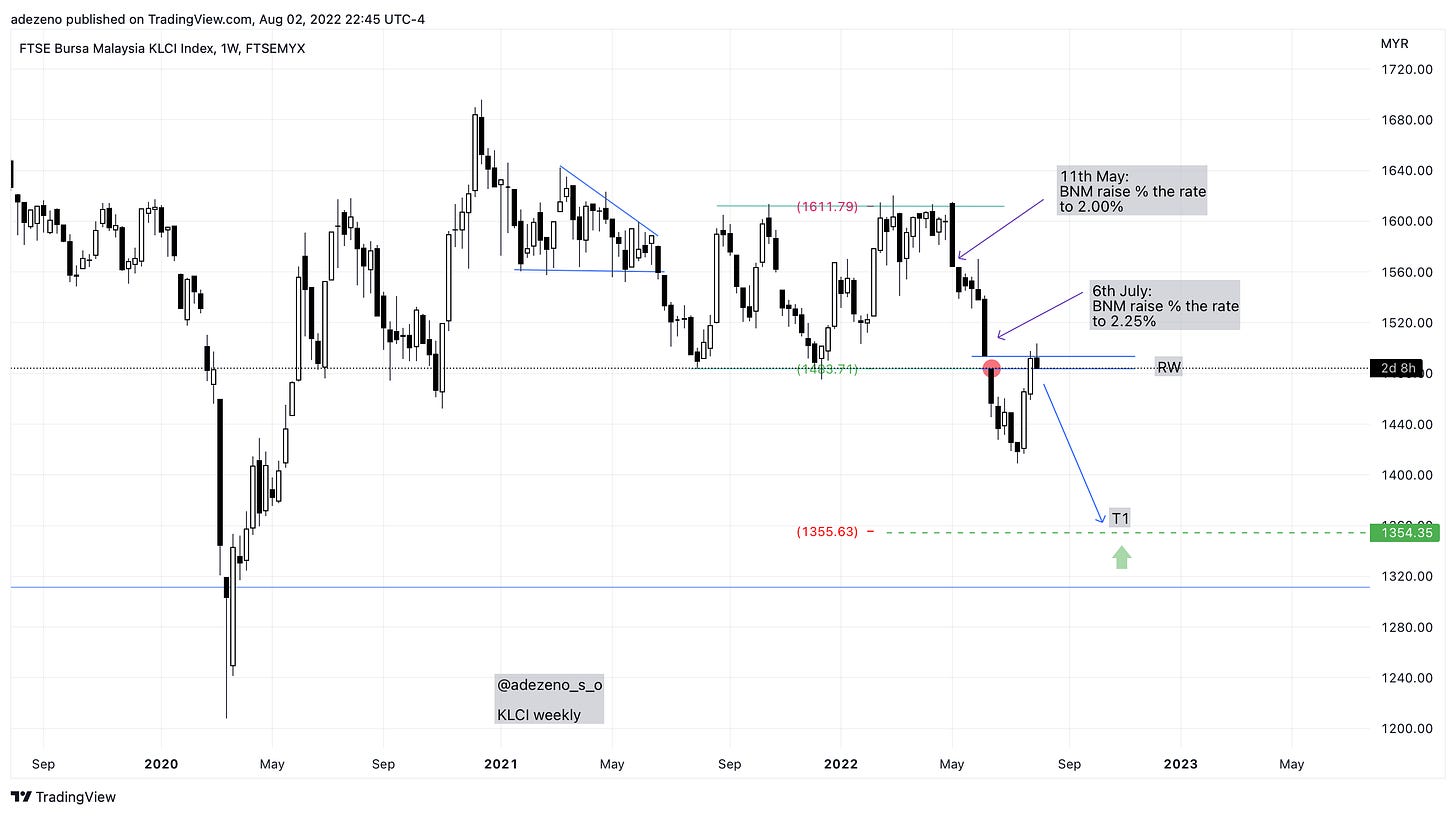

KLCI (Malaysia Blue Chip)

As we see on the KLCI weekly chart above (KLCI is an index to track Malaysia's blue-chip stocks). Both interest rate hike on the 11th of May & 6th of July brings a negative impact on Malaysia's KLCI index.

Price breakout from the bottom of the rectangle (red dot), will bring my price target to a measured move at T1 (price target).

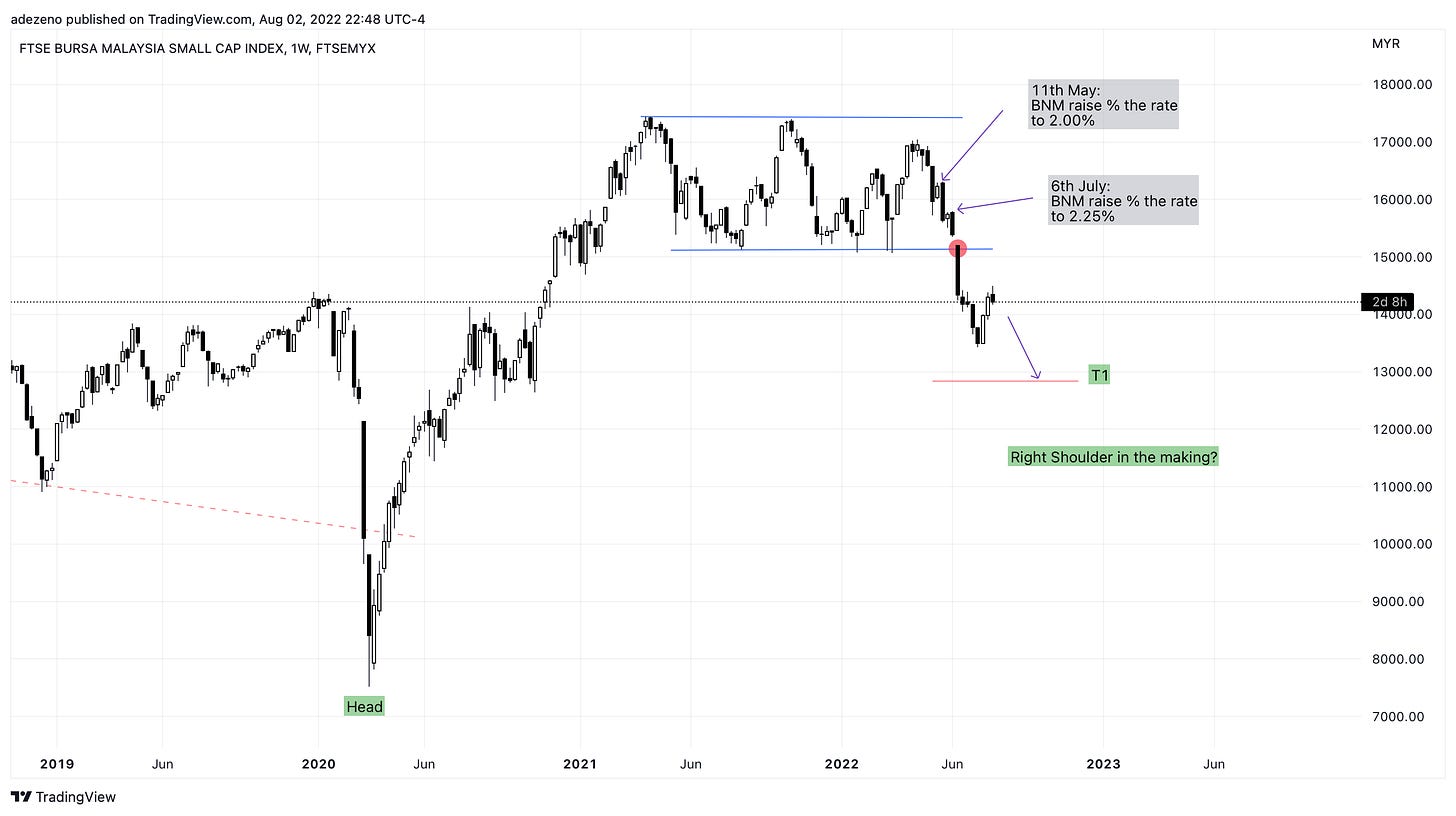

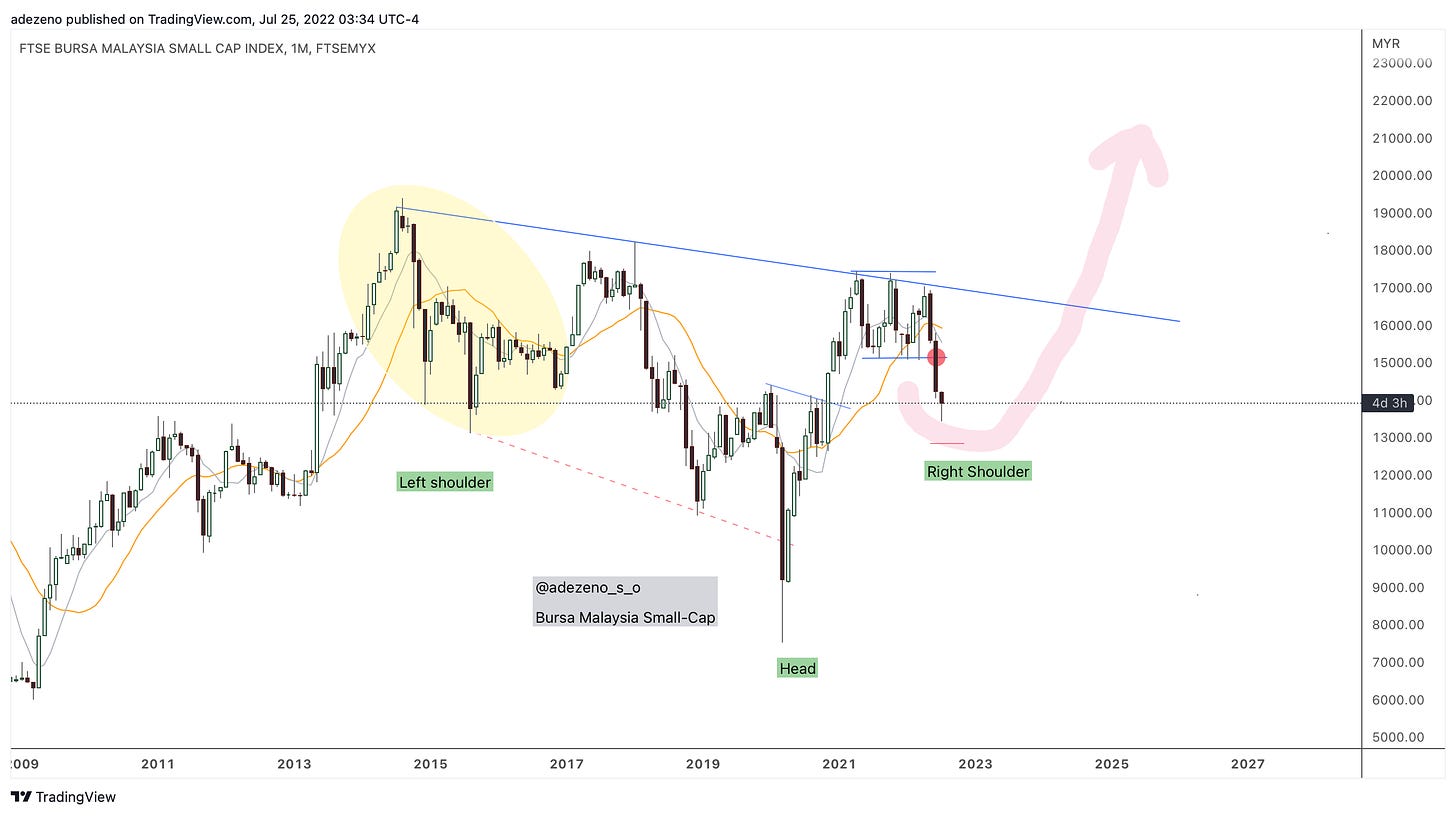

Bursa Malaysia Small-Cap

Malaysia Small-cap also paints the same picture. Both interest rate hike on the 11th of May & 6th of July brings a negative impact on Malaysia's Small-cap index. Price breakout from the bottom of the rectangle (red dot), will also bring my price target to the measured moved at T1 (price target)

What Malaysian investors should be aware of?

Looking forward, many economists anticipate another 25 basis points increase to bring the policy rate to 2.5%. If this happens, I believe the market push price lower to reach my price target at T1.

I know it’s a volatile market. But trust me, I have seen this before back in 2008. Seriously, this is not the time you want to sell your investment and run (doing so, you will realize your losses).

let me say this again. An opportunity like this comes once or twice in your lifetime. Please don’t miss out on these few lifetime opportunities. because once the market bottomed, it will take off like a bird.

The market only rewards patience investors.

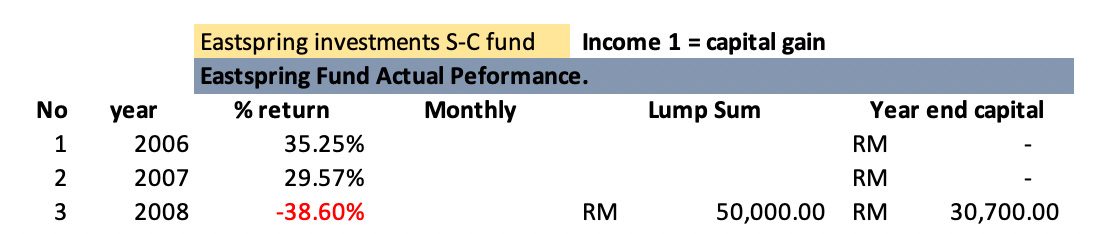

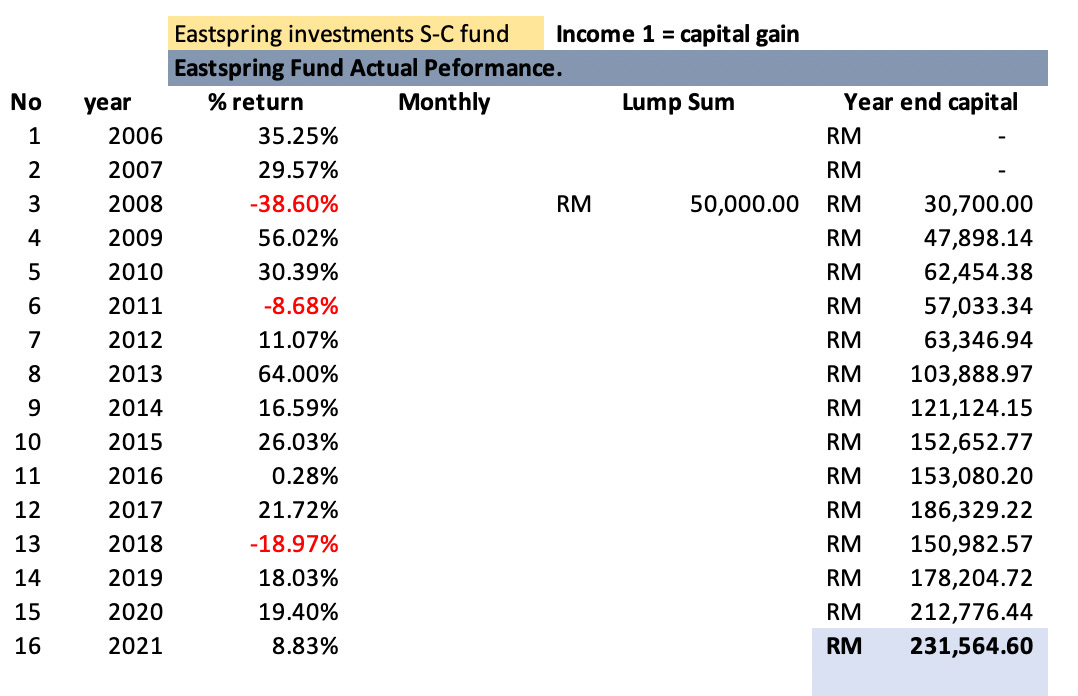

Let’s do a case study. You invested RM50K back in the year 2008, after 1 year your investment is down to RM30,700.

If you panic & sell your investment back in 2008, you will definitely lose money!

But if you hold, Your RM50K investment will turn into RM231K.

The light at the end of the tunnel

Here is my very long-term view on Malaysia's Small cap. Hold tight, this is not the time to panic and sell.

I will see you on the other side because the grass is greener on the other side.

** The rise of the interest rate will directly impact your Personal Loan, Housing Loan, ASB loan, or whatever floating loan that you took from the bank.